Some months back, a friend sent me a screenshot of a mobile banking transaction. The accompanying voice note explained how he was sending some money via 1LINK’s funds transfer, as usual. But this time, a notification popped up that the payment was automatically routed through Raast instead.

He wasn’t the only one to experience this. Industry insiders confirmed the forced rerouting of IBFT transactions to Raast was a routine occurrence amid push from the regulator. To him, it obviously made no difference. Who cares if the switch behind your transaction was Raast instead of 1LINK? Actually, the former is free so it’s probably better for the customer.

But it really matters to banks and the SBP, albeit for different reasons. For the former, fund transfers through 1LINK bring in fee income whereas the latter wants to push Raast, its flagship scheme, to achieve its own targets. So both have sort of competing interests with respect to the choice of switch.

The SBP wanted financial institutions to market the hell out of Raast’s P2P and had clear targets for traction. However, ensuring its uptake was going to be challenging because banks weren’t thrilled about free fund transfers. For the first few months, there were reports of delays in launches and many technical glitches. So after a while, it probably moved away from carrots to sticks i.e. the forced rerouting of transactions.

What the data says

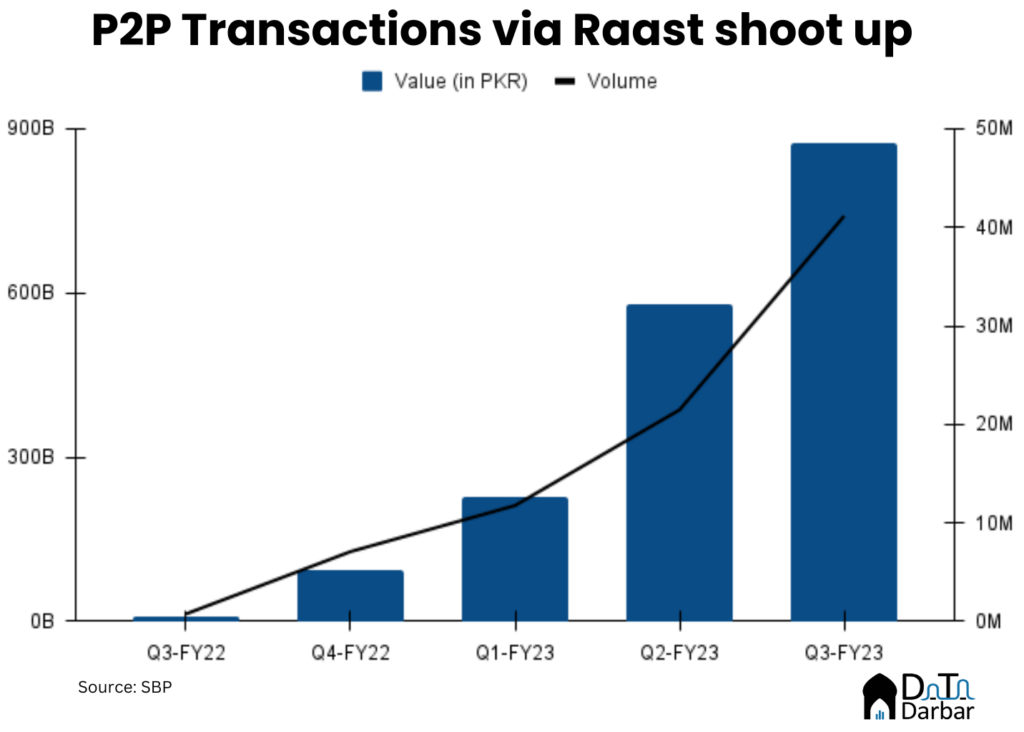

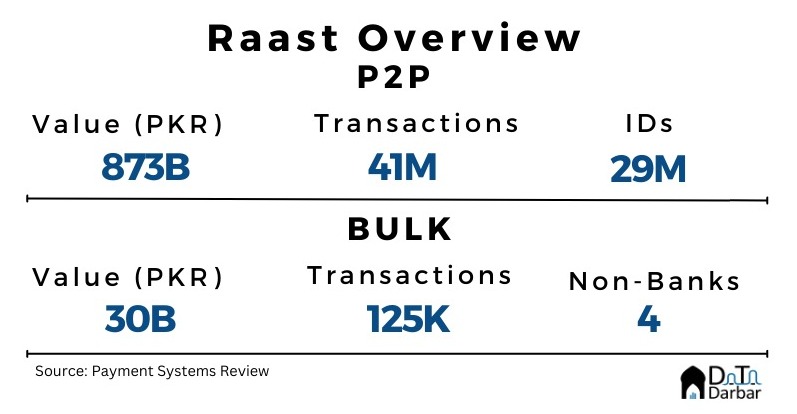

Don’t just take the banks’ word for it. Recent data adds credibility to this theory. According to the SBP, P2P throughput through Raast reached PKR 872.8B in Q3’FY23. That’s 10,612.6%(!) higher versus just PKR 8.5B in the same quarter of the previous year. This is phenomenal growth, even if coming off a low base.

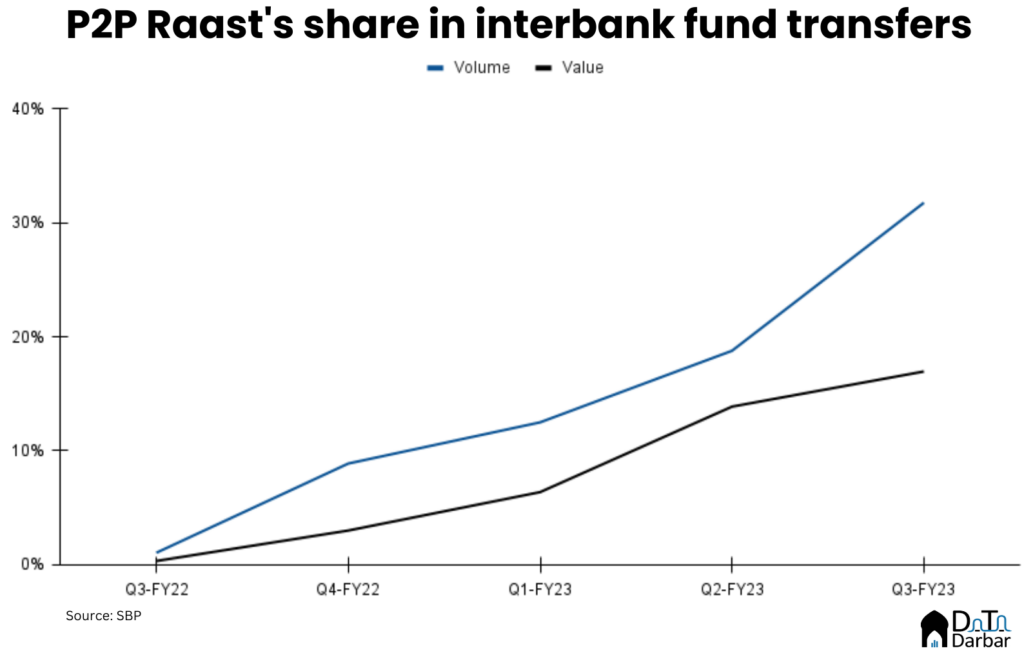

Let’s contextualize them. In Q3’FY23, total interbank fund transfer throughput was PKR 5.15T. Unfortunately, the SBP doesn’t categorize it down by segments but even if we assume all of it was P2P, Raast’s share in interbank value was 16.95%, up from 13.86% the previous quarter.

Volume-wise, Raast now accounted for 31.75% of all interbank transfers in Q3’FY23, increasing from 18.76% during October-Dec 2022. Remember, this is the minimum because there’d be some component of B2P and P2B in the total interbank numbers.

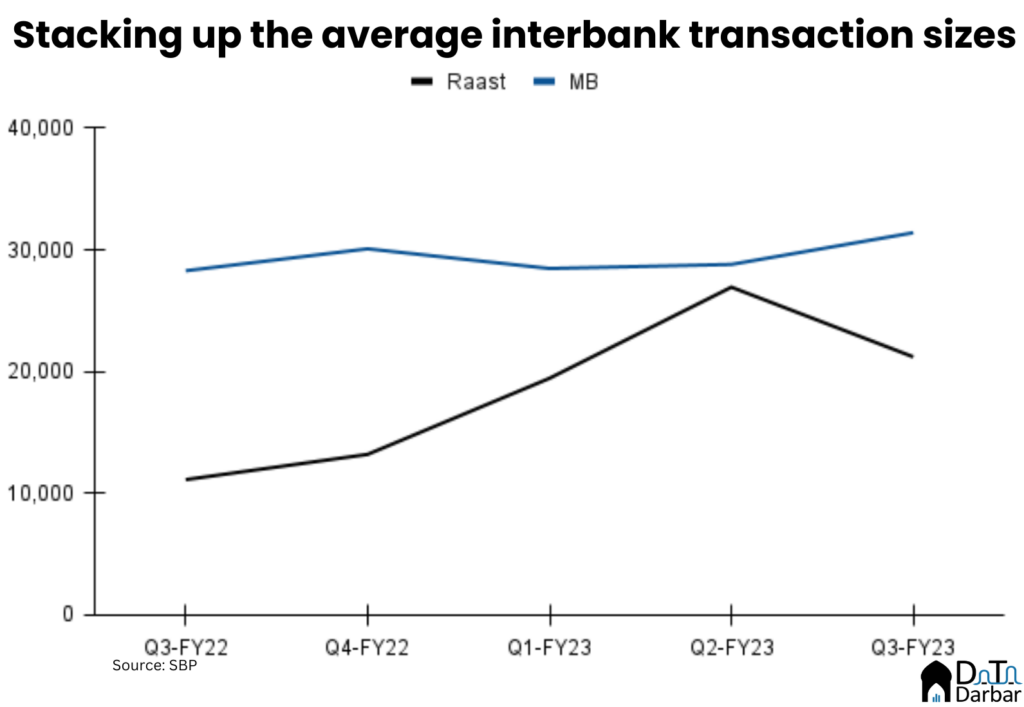

However, Raast, like UPI, is supposedly a low value, high volume switch. Meaning the average transaction amount should be small. But that’s not exactly happening, at least not since the last three quarters. According to the SBP data, the average P2P transaction via Raast was worth PKR 21,209 in Q3’FY23, compared to PKR 11,125 in the same period last year. This is not starkly different from the levels in mobile banking and the gap especially narrowed in October-December 2022 to just PKR 1,869.

Compare this to the mean transaction size of INR 1,727 via UPI and INR 68,401 through NEFT (for simplicity, think of it as the Indian 1LINK). Just look at how big the difference between the two is. So even accounting for the exchange rate differences, Raast processes far bigger payments on average for a supposedly low value switch and is not that distinct from the legacy option. It is not necessarily a bad thing, especially for the existing consumer who saves on paying fees. But beyond that, is the promise of proliferating digital payments being truly realized?

I mean online fund transfers, irrespective of the switch, have already been on a steep trajectory. Since Covid-19 — the trigger event for the rise of retail e-banking in Pakistan — interbank throughput has increased from PKR 444.3B in Jan-Mar 2020 to reach PKR 2.66T by Q3’FY22. Similarly, volumes rose from 8.48M to 73.43M in the corresponding period.

This translates into average QoQ growth per quarter of 23.94% and 27.94% in value and volumes, respectively. The YoY increase was obviously far higher at 135.21% for throughput and 158.55% in transaction count. That’s before the rollout of Raast’s P2P functionality. Understandably, the upward trajectory has largely continued since then too, albeit at relatively slower rates due to higher base. But the point is, it hasn’t significantly changed anything. At least so far. Yes, it’s free so there’s benefit to the consumer but what beyond that?

Building new use cases

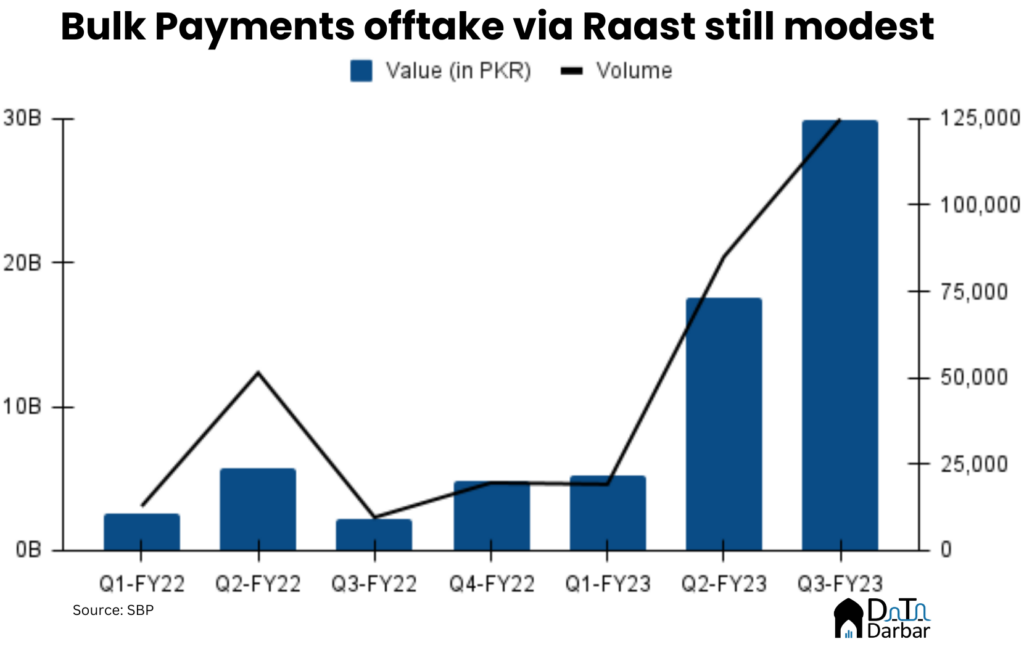

For example, the relatively older bulk payments module remains a complete disappointment with throughput of just PKR 29.9B across 124,900 transactions in Q3’FY23. I mean, interbank fund transfers process almost twice on a DAILY basis. And remember, this is bulk so the values are supposed to be even higher.

Similar is the story of the request-to-pay which whose initial launch was in November 2022 and then in June 2023, but there’s barely any update on it. So when it comes to building a broad-based unique use case from ground up, Raast hasn’t really lived up to the mark. But with so much hype created, the regulator was probably under pressure to signal some performance at least. Thus, it took the easier path: forcing banks to reroute IBFT transactions. At least this yielded numbers.

A more positive way to look at this is that the regulator is finally taking charge. Instead of letting banks shirk around, it’s making them migrate to Raast, by hook or crook. Unlike the somewhat lethargic approach SBP took with respect to PayPak years ago. Plus, it offers the end consumer a free service. Which is obviously fair, but the problem is a little deeper and forced routing of transactions just won’t solve it.

It’s the governance structure, stupid

It has to do with the governance structure of Raast. Its development was outsourced and is currently managed by a pretty small team, many of whom aren’t even full-time. In fact, Karandaaz pays their salaries through a Bill and Melinda Gates Foundation grant. Unlike UPI, which is run by the National Payments Corporation of India, an independent non-profit owned by the central bank, this is more of a hotchpotch.

For Raast to realize its potential, it needs both institutional capacity and ownership. Just a few men in leadership roles might not be enough as is currently the case. Unless the regulator is content with forcefully eating away 1LINK’s share and touting that as a digital payments revolution.

As long as it’s free, itll work

.