Every Karachiite is well aware that Saddar is THE place to buy all kinds of random stuff, from crockery to phone cases. I mean there are other neighbourhood options too but none can really match on variety or price. But the whole experience requires effort and patience to deal with the city’s traffic. And why bother when you can find many of the same products on Daraz at competitive rates?

This was the thought process for many until AliExpress improved its delivery timelines and Temu entered the market. Now, it no longer makes much sense because why not go directly to the source i.e. China? Many large marketplaces in other emerging markets in Southeast Asia face the same problem.

At least anecdotally, Daraz seems to be affected but what do the numbers say? Well, we don’t know that yet because the financials for FY25 — i.e. the period when Temu really took off in Pakistan — aren’t yet available. However, even before that, the Alibaba-backed e-commerce platform has been struggling.

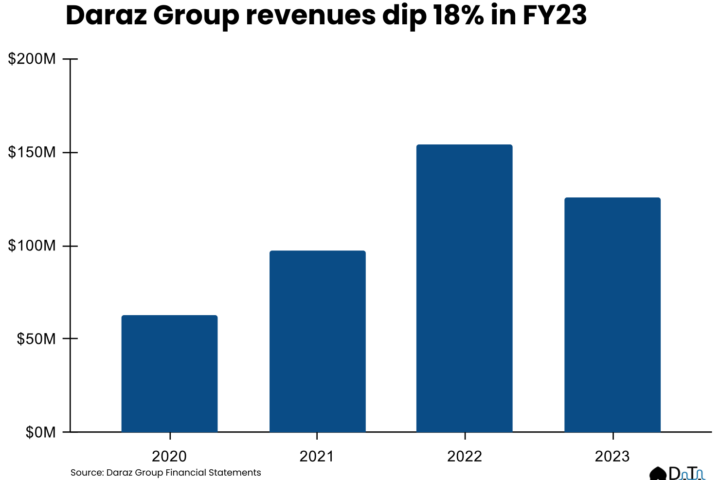

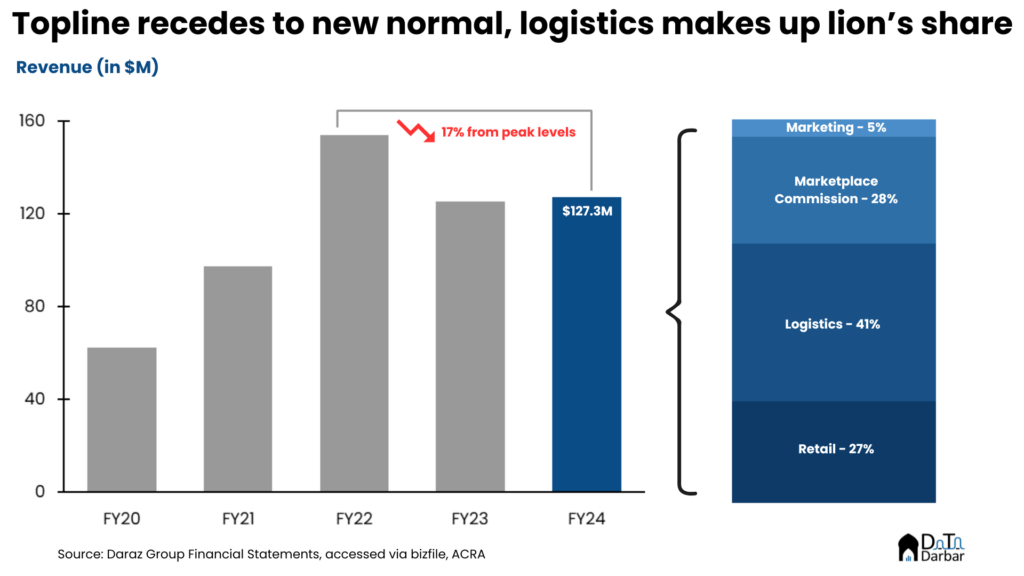

Revenue edges up but falls well short of peak

During the year ending March 2024, Daraz Group, which includes all markets it operates in, posted revenues of $127.3M, barely up 1.5% YoY from $125.9M and well below the peak of $153.9M seen in FY22. Now, let’s dig a bit deeper to see what’s driving the performance. The group has four revenue streams:

- Retail: what Daraz has on its own inventory before selling

- Marketplace Commission: where the company sells goods as an agent

- Logistics: Revenue from warehousing and delivery services

- Marketing: Ad spaces (and solutions) sold

In the past, Daraz used to earn a large chunk of revenue from retail i.e. more than half until FY23. However, that share has come down substantially since then, reaching 26.7% in FY24. The problem is that the decline is not only relative but also absolute: more than halving from peak levels.

On the other hand, income from logistics has become the biggest driver, contributing 40% to revenue, followed by commission adding another 28%. Both these streams have also managed to grow consistently throughout the years, if not explosively. Meanwhile, marketing solutions had a major setback, plunging 33% YoY in FY24. There was also a $4.1M contribution from other income, which in FY23 incurred a loss of $25.9M.

Spending more to do less

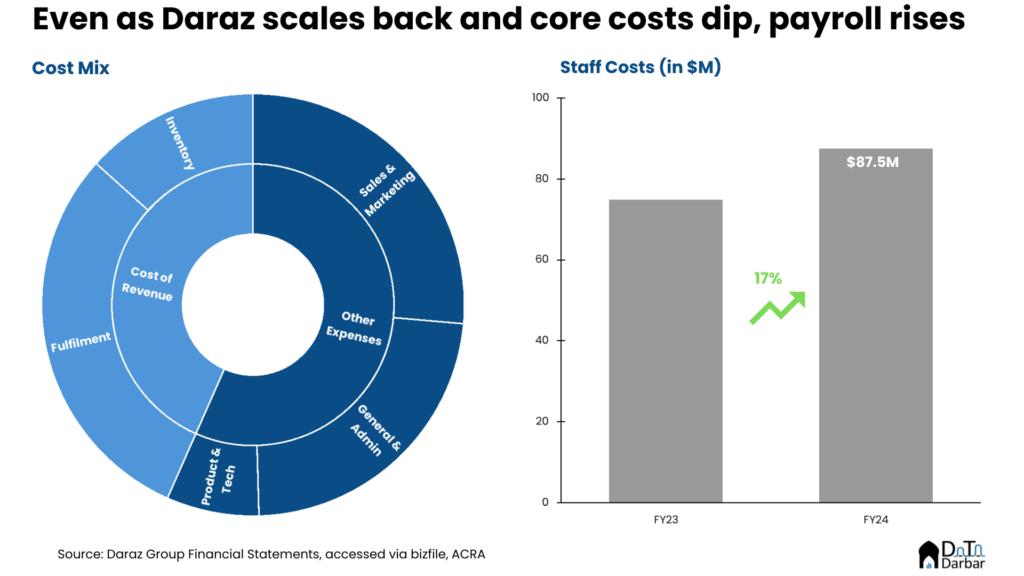

For the outflows, we need to look at two levels:

- Cost of Revenue

- Inventory

- Fulfilment

- Other Expenses

- Sales & Marketing

- Product & Tech

- General Administrative

First, the cost of revenue dipped 11.6% to $112M in FY24, comfortably the lowest in four years. Breakdown shows that both inventory and fulfillment expenses were down, suggesting a managed scaling down of operations by Daraz. But for most platform-based companies, the biggest burden is usually parked in other expenses: line items like sales & marketing, product & tech, and of course, general admin.

These expenses continued to widen by 9.8%, reaching $146.3M by FY24, the steepest on record. What’s interesting here is that sales & marketing costs actually slipped by 3.2% to $68.3M and yet, the general admin and product expenses trended upwards. Basically, even as the company’s actual footprint declines, overheads are ballooning.

Take payroll for instance, which forms a core component of each line item mentioned above. Cumulatively, these staff costs not only rose by 17% to $87.5M in FY24, but even their share in total expenses (excluding inventory) hit over 39%. In the previous year, Daraz was paying under 35 cents for human resources on every dollar of expenses. So either they are hiring troves of people or paying the existing employees big salary bumps. Not sure if any of the two options make sense given the topline and bottomline.

Bottomline: still a bloodbath

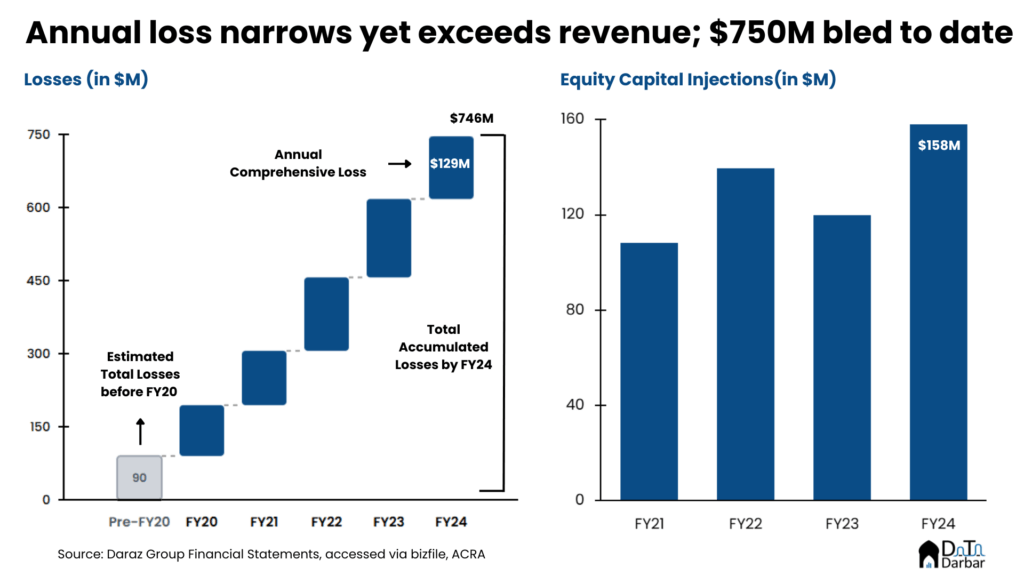

Thanks to the decline in cost of revenue, Daraz AT LAST managed to achieve gross profitability of $15.2M in FY24, compared to a loss of $1.4M the year before. That means the group posted a positive gross margin, at almost 12%. Put another way, they are finally selling goods worth $1 for $1.12. Previously, it used to be less than what it cost them.

But because other expenses showed no reprieve, total losses clocked in at $129.4M. Technically, it can be considered an improvement from last year when Daraz bled by $144.4M but that’s barely a good yardstick. Perhaps the more appropriate way to look at it is that the group has incurred more in losses than it actually made in revenue. More simply, to sell a good worth $1, they have to bear another $1.01 out of pocket.

Remember it’s not a one-off instance either: this story has played out pretty much every year for the last half decade. Makes you wonder when exactly those promised monopoly effects and pricing power effects will materialize? Or even show the barest of signs? Since inception, Daraz Group has accumulated losses of ~$750M on the balance sheet, thus requiring continuous injections from the sponsor. In FY24, it converted a loan worth $29M from Alibaba into equity while receiving additional funding of $129M, taking the total money pumped so far at $884M.

To be fair, this is probably on par with the capital requirements of anyone trying to create a category-defining business across multiple emerging markets, especially ones with high economic volatility. But usually in those cases, there are at least clear signs of growth and path to profitability, that too a decade later. Daraz appears to be fulfilling neither of those conditions.

Is the sponsor fatigue kicking in?

So what does Alibaba do in such a situation? In the words of Damodaran, should they keep throwing good money at bad or step back and let it be? On the surface, the sponsor seems to be taking the latter approach. In its FY25 report, Daraz didn’t even get a logo placement in the “Alibaba ecosystem”, a fairly simple overview of key brands.

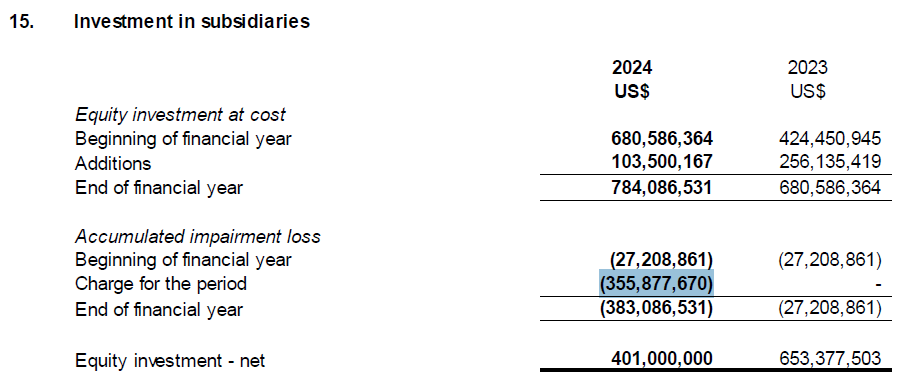

Sure, this is quite harmless and may not mean much but there MIGHT be more to it than meets the eye. In the FY24 financials, Daraz Singapore booked an impairment charge-off at $356M, reducing the carrying value of its subsidiaries. In other words, it no longer believes all the money capital invested so far can be recovered.

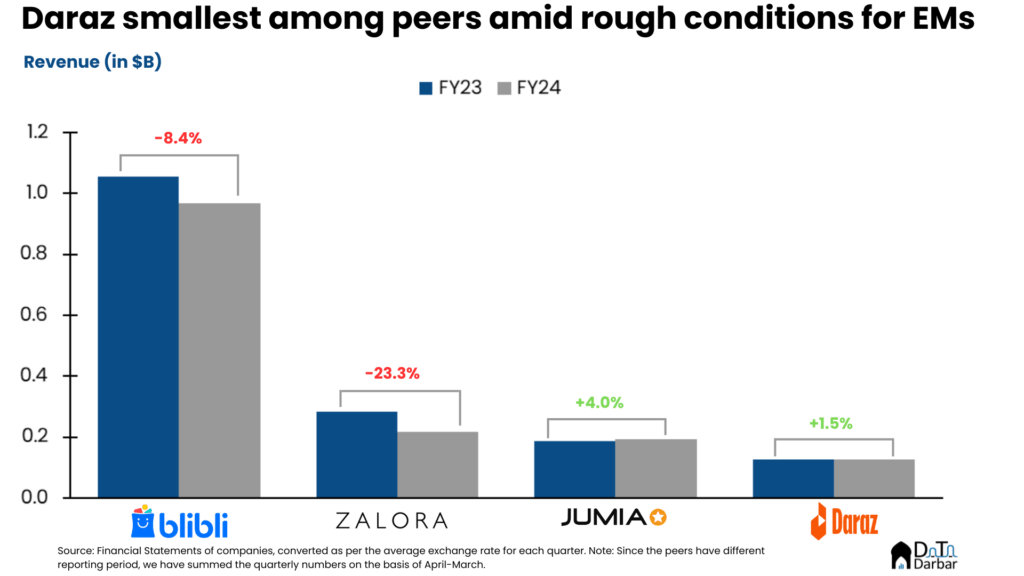

Among peers of somewhat similar size, Daraz remains the smallest and has the lowest gross margins, despite them facing a rough year as well. Obviously the economic conditions of Daraz’s markets have played a major role in this. Just to remind, between April 2023 and March 2024, Pakistan saw one of its worst economic crises ever. Sri Lanka was in no better shape, and even Bangladesh struggled. So the risk was pretty high, as evidenced by the 31.5% discount rate used for projections.

But more than a decade later, one has to ask when exactly is the scale, let alone profitability, going to kick in? And that was mostly without any serious competition. Now that Temu is also in the game, we can only guess what the impact must be and will find once the numbers become available for FY25.

PS: The financials of Daraz do not provide a breakdown for Pakistan but I will soon be publishing my attempt at estimating Pakistan’s share in the group.