Classifieds were among the first real use cases for the internet: a digital bulletin board where you could buy, sell, and trade without the hassle of newspaper ads or physical marketplaces. Over two decades later, they are still relevant, with Dubizzle, formerly Emerging Markets Property Group, listing this week. The company has a pretty interesting history and is one of the largest in its category by geographic coverage, which at one point stretched from Mexico to Southeast Asia.

However, in the IPO prospectus, Dubizzle has taken a more regional view of growth and hints at room for further category expansion in the Middle East & North Africa, instead of serving all emerging markets (probably explains the rebranding). There’s a lot to unpack in the prospectus but for now, I will stick to the main listing.

- Total Offer: 1,249,526,391 shares

- New Shares: 196,114,887 (15.7%)

- 1,053,411,504 (84.3%)

- Offer Size: 30.34% of post-listing share capital

It’s an offer for sale for the most part — meaning existing shareholders will sell their stake to the public. Only 15.7% of the offer entails issuance of new equity. Meanwhile, ~85% of the capital raised will actually go to the pockets of shareholders, rather than the company for additional growth.

“The principal use of the net proceeds of the Offering received by the Company will be (i) to settle the employee stock ownership plan; (ii) to fund strategic M&A opportunities; and (iii) to maintain strategic flexibility for growth going forward,” as per the prospectus.

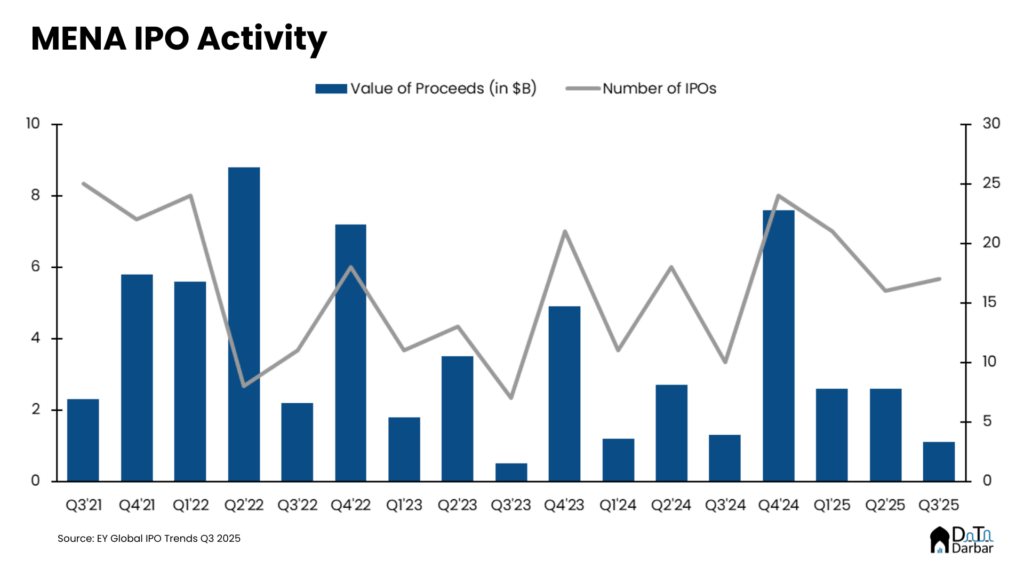

On the first look, the share of OFS seems steep even if secondaries have become popular of late. It might even be a regional trend. In its MENA IPO Eye Q2’25, EY notes: “The nature of IPO proceeds shifted notably in Q2 2025, with a decline in primary listings and combination listings, while secondary listings dominated. This trend suggests a cautious capital-raising environment, with issuers favoring liquidity events over fresh equity issuance.”

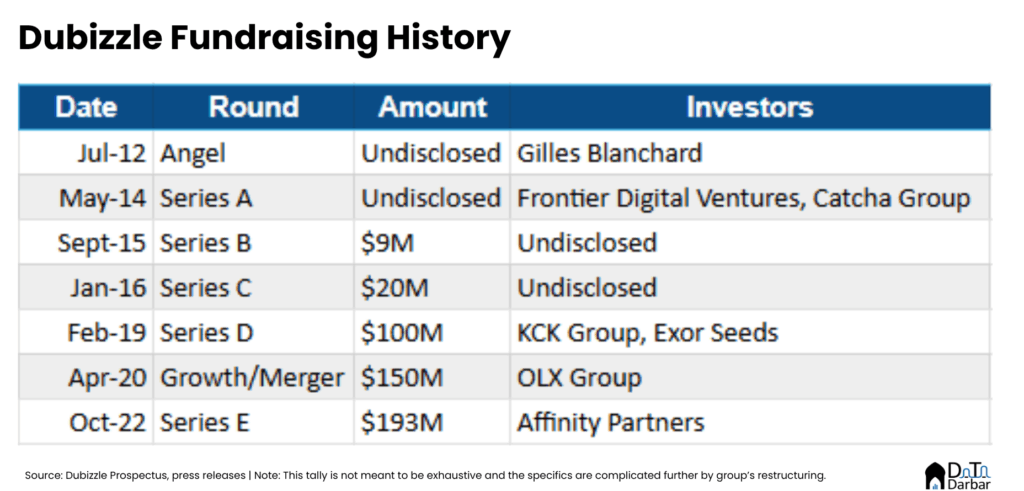

The more interesting bit is probably who’s selling out their shares. Just to set the context, Dubizzle is among the most well-funded companies in the region, having raised ~$470M since inception. Their cap table has some big names, including Prosus, which owns a quarter of Tencent, and Affinity Partners, run by Trump’s son-in-law, Jared Kushner. So they have been able to rake in plenty through private markets and going public is simply an exit pathway, rather than an avenue to secure more funds.

For now, there’s no guidance on price, which will only be finalized after the second tranche of book building. But again, let’s do some rough numbers based on what’s going around in the media:

- Reported Target Valuation: $2B

- Total Shares Post-Listing: 4.12B

- Implied Price Per Share: $0.486 (≈ AED 1.78)

- Total Offer Proceeds: $607,269,826

- New Shares: $95.2.4M → to company as new capital

- Sale Shares: $511.56M → payouts to shareholders divesting their stake

Who’s gonna make bank?

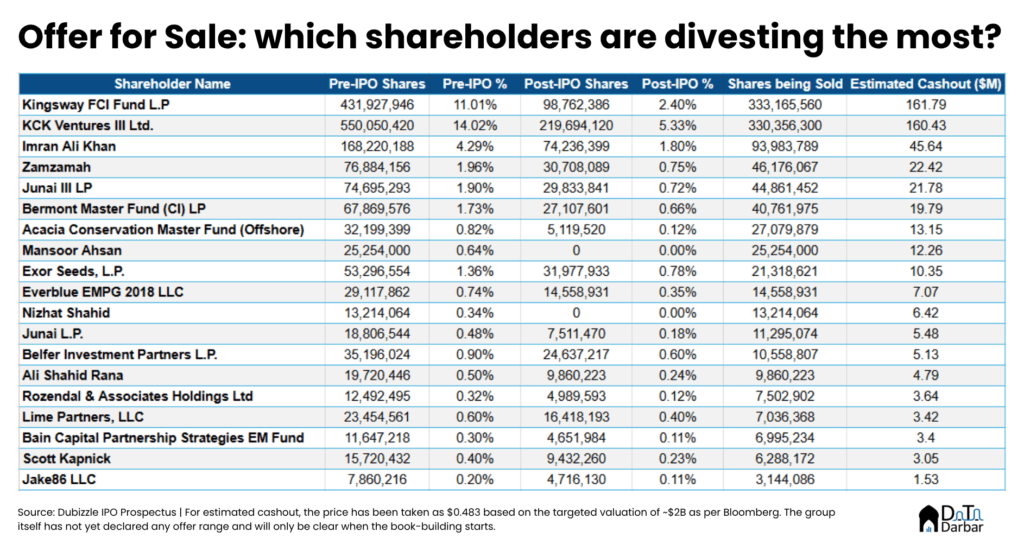

Perhaps the more interesting question is who all are divesting? Or in other words, which investors will make bank by selling their shares to the public? More importantly, how much are they set to gain as a result? In absolute terms, Kingsway and KCK Ventures are looking to part with over 330M shares each, and will reduce their stakes to single digits post-listing. Imran Ali Khan, the co-founder and CEO of Dubizzle, is also eyeing to sell almost 56% of his equity.

Globally, the exit environment has shown signs of reprieve and MENA, for its part, seems to be much better placed. According to EY, the region saw 54 listings in 9M’24, substantially higher than the same period in past three years. Value of proceeds was $6.3B, up 21% YoY. However, the choice of exchange is interesting because lately, Saudi Tadawul has driven more than half the activity.

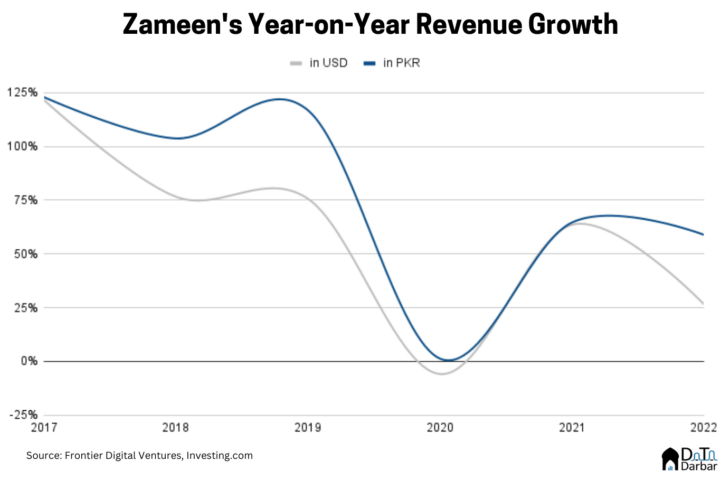

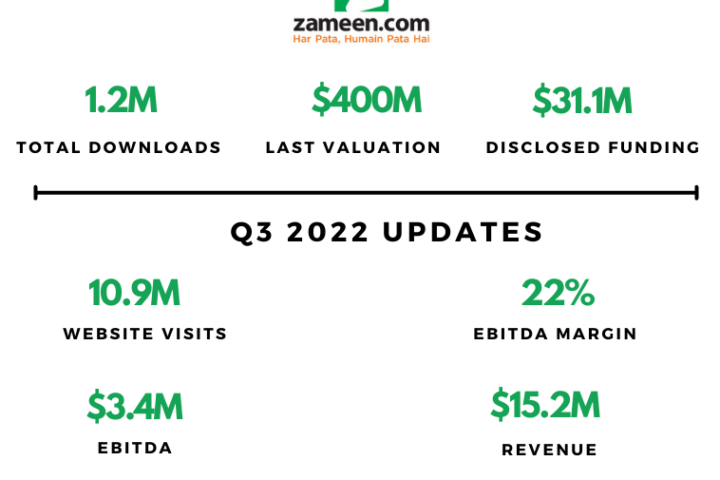

That’s it for now. I will probably be back with some takeaways on the Dubizzle restructuring because that’s quite interesting in itself, given that the group let go of its original asset, i.e. Zameen.com