The once-thriving Pakistani tech startup ecosystem has hit a rough patch, with only one funding deal disclosed in the 1st half of 2024. Even the old guard is feeling the pinch, as evidenced by Zameen’s latest financial results. While the proptech giant showed signs of recovery from the devastating lows of 1H2023, the first half of 2024 has failed to deliver the anticipated rebound. Instead, the company finds itself mired in a period of stagnation.

Zameen’s fortunes are inextricably linked to the property market, given its dual role as both an aggregator and developer. This exposure has left it vulnerable to the recent downturn in Pakistan’s real estate industry. Several factors have contributed to the decline, including increased taxes on property transactions and high inflation in construction materials, which has been a drag on the overall sector.

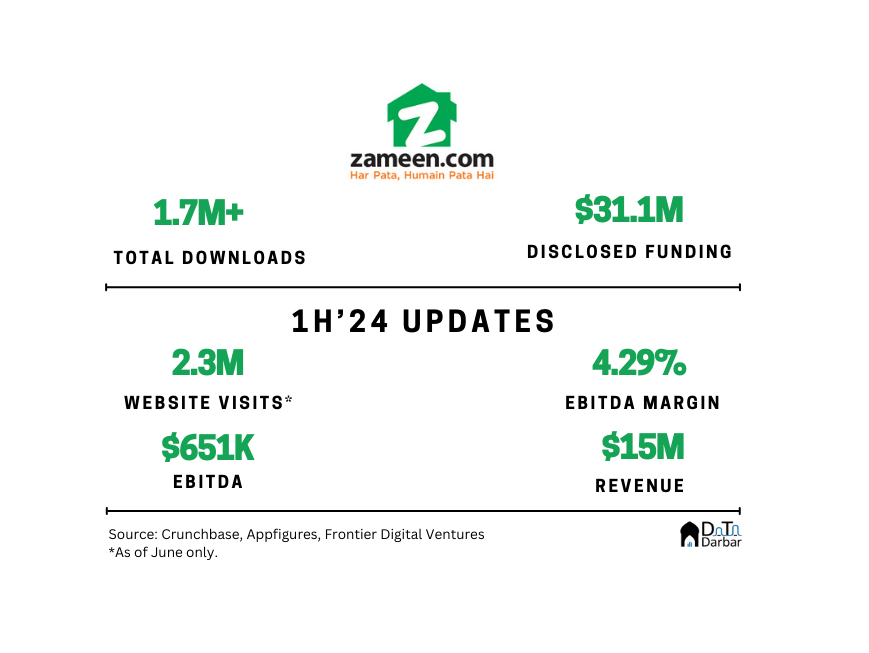

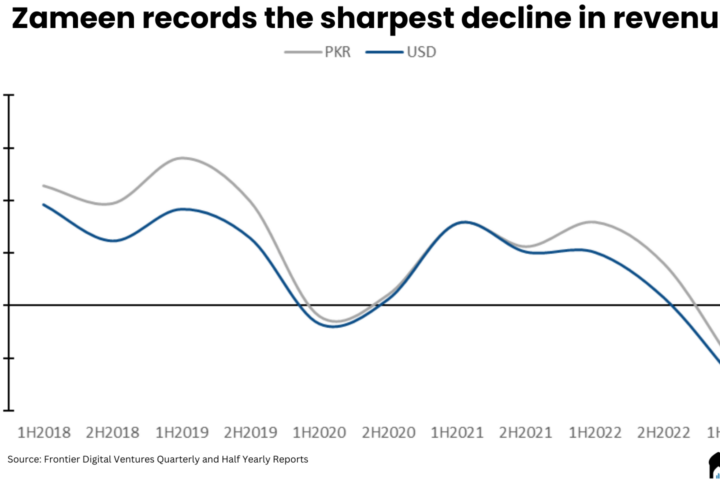

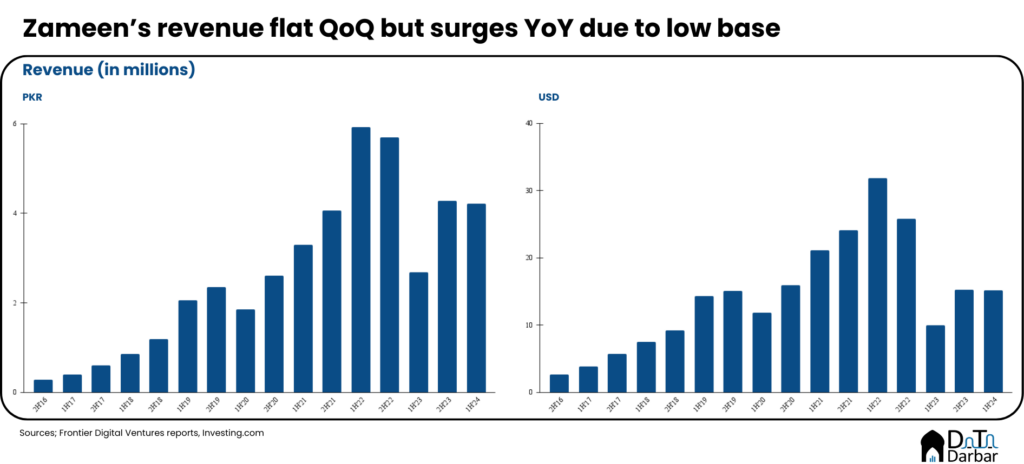

The impact on Zameen’s financials has been stark. Revenue for the latest half-year period has plummeted to around $15M, reminiscent of 2019 levels. This represented a dramatic fall from the heady days of late 2022 when the company’s topline soared past $30M. Of course, the currency blues have played a role over the last half-decade but that’s not all the story. Even in rupee terms, the topline of PKR 4.2B during 1H’24 was below three out of the last four halves.

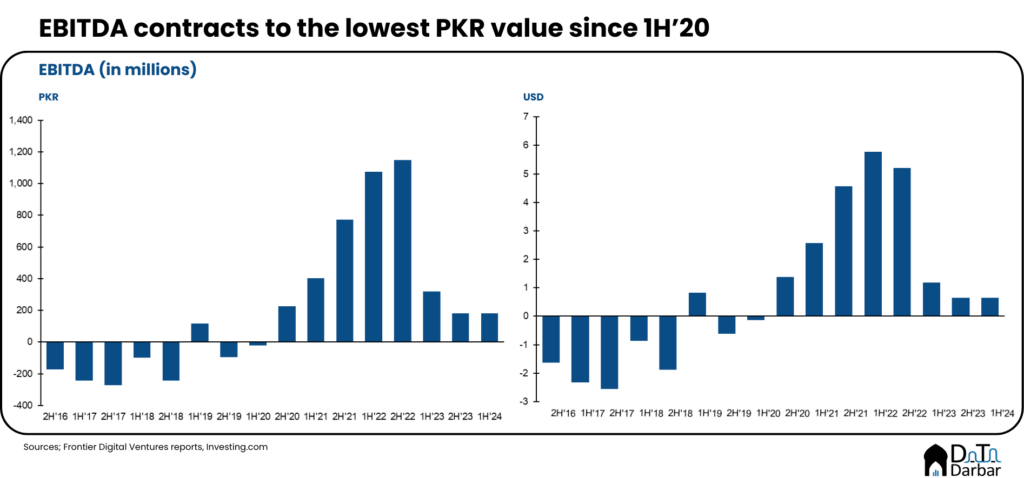

The sharp decline in revenue has cascaded through the P&L, with earnings before interest, taxes, depreciation and amortization nosediving to PKR 180.9M, the lowest since the second half of 2020 when the company became sustainably EBITDA-positive. In USD terms, the situation is only slightly better as it barely edged up QoQ to $651K.

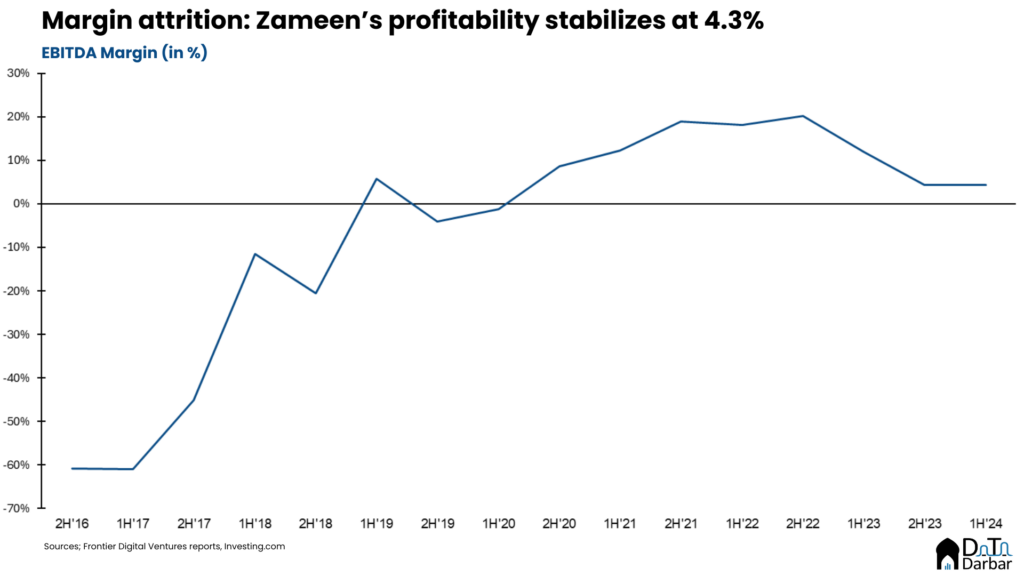

More alarmingly, the EBITDA margin plunged to a mere 4.29%, the lowest since 2H’20. Compared to the same period last year, it was down 765 basis points and against the peak of 20.17% in 2H’22, the attrition is 15.88pps. This dramatic compression signals not just a revenue problem, but a deepening cost crisis.

Construction Blues

Of course, this is part of a wider rot in Pakistan’s economy where most macro indicators, such as inflation and forex reserves, hit their worst levels in the first half of 2023 and coincided with Zameen’s revenue dip. Understandably, in this environment, the real estate market was bound to feel some pressure, which continued for the subsequent 12 months. Anecdotal evidence paints a dismal picture of the sector with prices declining and buyers scarce.

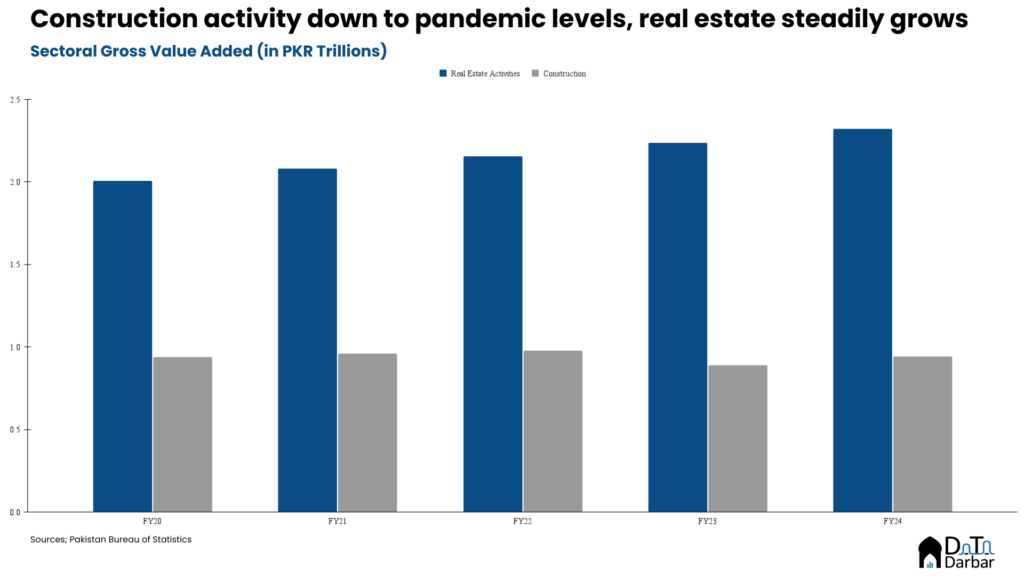

However, Zameen’s woes seem to run a little deeper. According to data from the Pakistan Bureau of Statistics, gross value added of real estate activities has held on its own, maintaining an average growth of 3.8% between FY15 and FY24. In contrast, overall GVA rose by 3.5% during the same period. Given that the company also develops properties, perhaps construction activity would be a better indicator.

That sector has seen a lot more variance, with GVA down thrice in the last 10 years. FY23, in particular, was bad with the latter two quarters plunging 5.9% and 22.3%, overlapping with Zameen’s worst decline. While there’s been a recovery of 5.9% in FY24, GVA is the lowest since FY17, sparing the year of Covid-19.

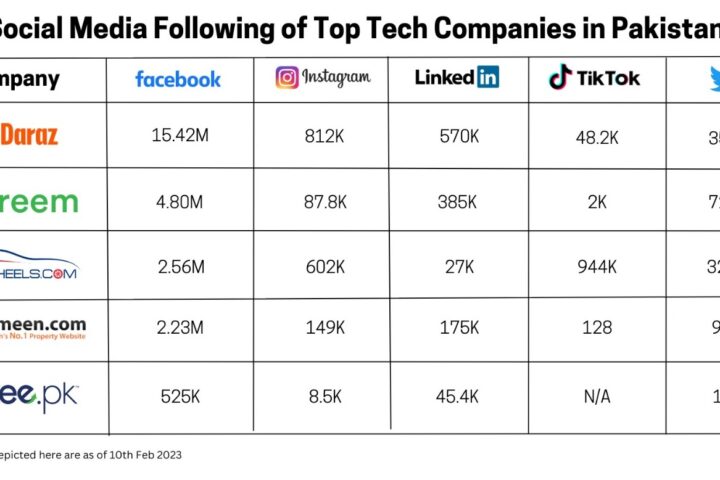

Zameen’s performance falls behind peers

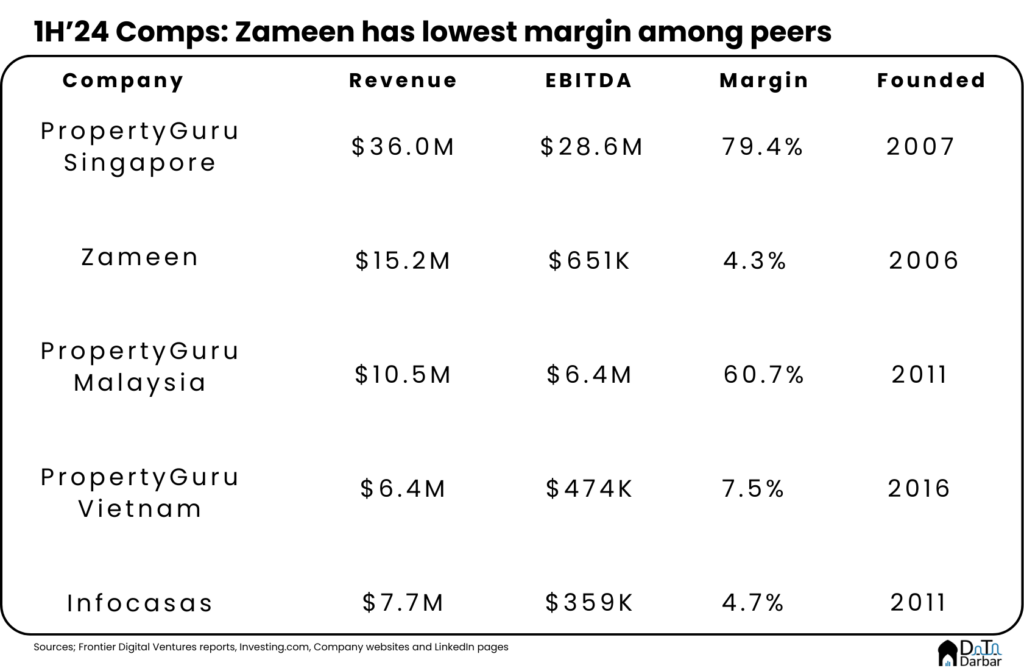

Whether because of macroeconomic troubles or something internal, Zameen’s performance compared to peers is now lacking. Until 2022, its revenue was the largest in our sample, ahead of PropertyGuru Singapore but that has long changed. In 1H’24, that difference was more than twice though the company regained its lead against PropertyGuru Malaysia. However, EBITDA lags behind both.

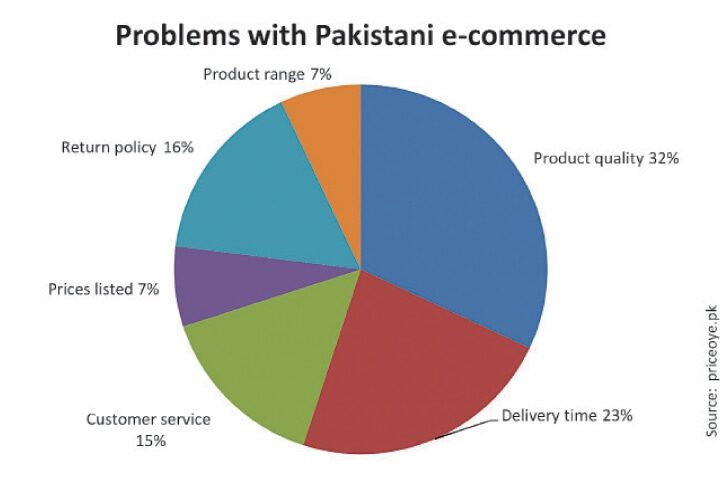

The real divergence is visible in profitability, where Zameen’s EBITDA margins of 4.3% were the lowest in the sample. Remember, the company is the oldest in this group and effectively controls the internet-based property leads market, along with a decent footprint in upscale real development. To be fair, it never had any comparison with PropertyGuru Singapore and Malaysia, both of which have extreme margins above 50%.

As highlighted in our older notes, there is a world of difference between the unit economics of Zameen’s two main revenue streams: classified and transactions (development). The former wasn’t even 70 cents in 2022 and by Data Darbar estimates, accounted for less than 10% of the topline. This is quite different from Southeast Asia where the marketplace model has delivered better results. On the other hand, the latter, despite being more lucrative, is too cyclical, just like any builder out there. No amount of data can make you immune from that boom and bust curve.