Things haven’t been easy for Pakistani tech startups, with few funding deals and big closures. Even the stable companies are now feeling the heat, as Zameen’s latest financials show. Until last year, the revenues of proptech giant were scaling fresh peaks while growing in high double digits. But A LOT has changed this year, as the ghosts of Pakistan’s macroeconomy finally caught up with them. So it’s time to do an update.

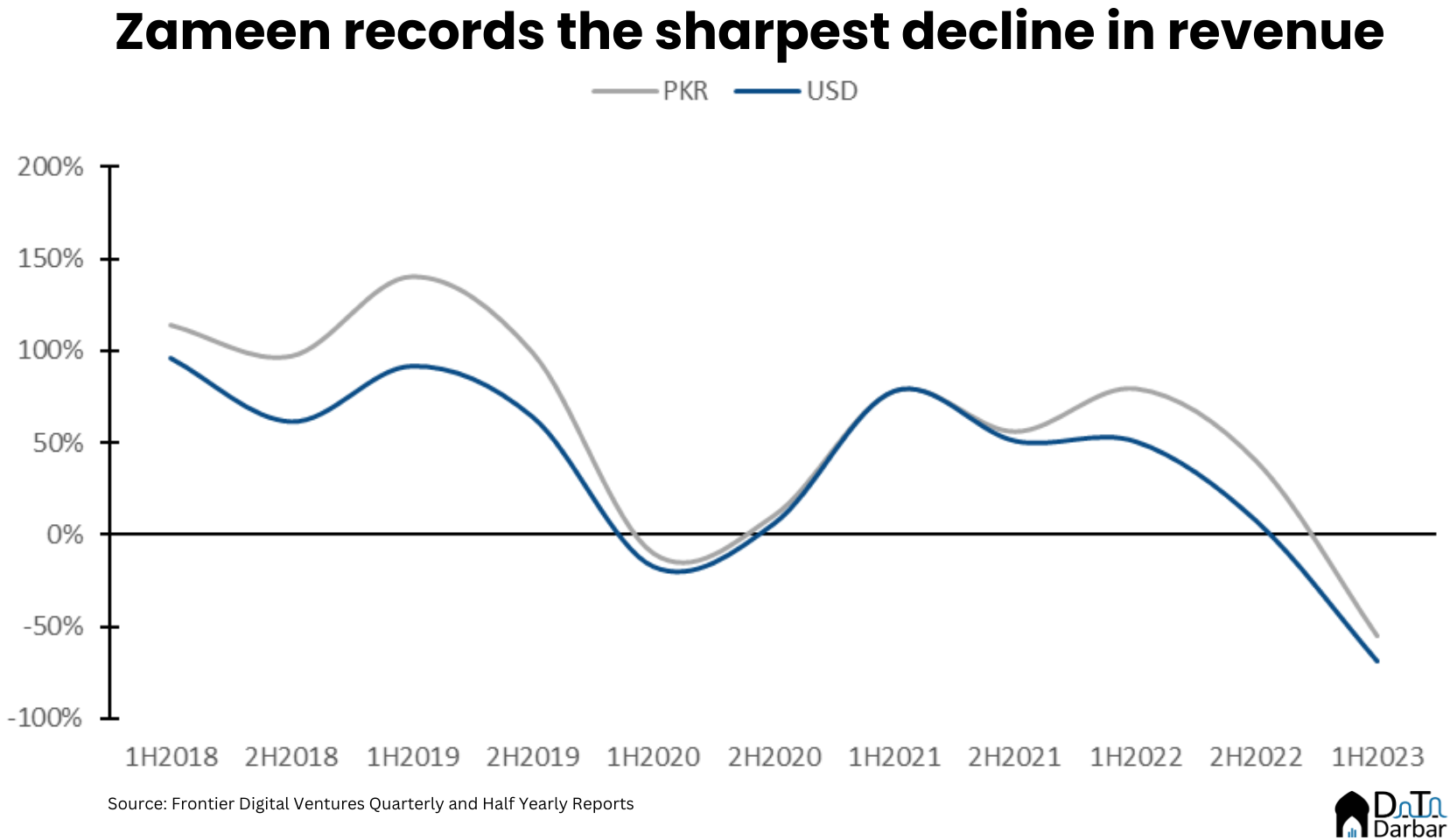

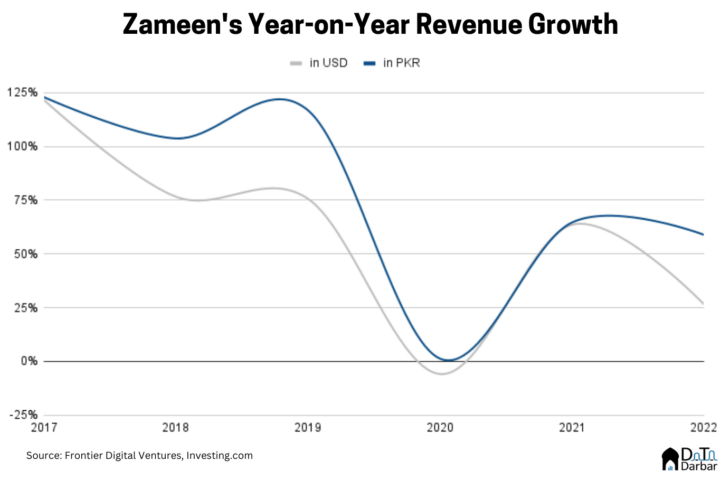

Zameen’s revenue tanked like never before, plunging by 54.7% to PKR 2.7B in 1H2023 from PKR 5.9B in the same period last year. For context, this is the only half-yearly period except for peak COVID-19 when the company’s topline has fallen YoY.

However, there were probably early signs of trouble when the topline had edged lower by 3.9% to PKR 5.7B in 2H2022 compared to the preceding period. In USD, the latest decline was even steeper as revenues nosedived to $9.9M, down 68.8% YoY and 61.5% compared to the second half of last year. This is the first time since 2H2018 when the number has slipped under $10M. So, no matter how you look, the picture looks grim.

Similarly, EBITDA dipped to just PKR 320.4M in 1H2023, sliding by 72.1% over the preceding period and 70.2% YoY. Again, the decline is sharper in USD at 79.4% and 77.2%, respectively to close at $1.19M. As a result, EBITDA margins clocked in at 11.94%, the lowest since 2H2020.

What went wrong?

In its 1Q2023 report, FDV, which owns a 30% stake in Zameen, had attributed the slump to Pakistan’s macroeconomic situation. Consequently, transaction volumes were lower as people shied away from investing in property. However, they argued that the numbers were obscured by the depreciation of the rupee. In this quarter, the rupee had depreciated by 25% to the dollar. But that doesn’t explain the visible slowdown in PKR.

The report from the second quarter was a little more encouraging, as FDV reported a 10% increase in revenue in May, supposedly showing signs of recovery and a lift in market sentiment. In addition, it noted that the positive EBITDA in these conditions was a sign of the entity’s ability to navigate a subdued market. Unsurprisingly, resilience was also the theme of the marketing campaign initiated by Zameen. The investor outlined the reasons why it sees a prosperous future for its star portfolio company:

- There will continue to be strong housing demand because of the growth in the Pakistani population.

- High interest rates will have a minimal effect on housing demand because of mostly cash-based financing.

- Zameen is the largest player in the online property market, with 32x the audience of its largest competitor.

What’s interesting is that FDV took Lamudi as its largest competitor even though Graana has twice the website traffic. Though Zameen is still well ahead of other property classified portals, 32x may not be an accurate representation and exaggerates its performance significantly.

How’s the industry doing?

But assessing the performance in isolation is never a good idea so we must examine how the company fared with compared to others in the industry. Since no data is available for local peers, we had to settle for regional counterparts. While Zameen led in revenue during 2022, it has now slipped to the third position in the rankings.

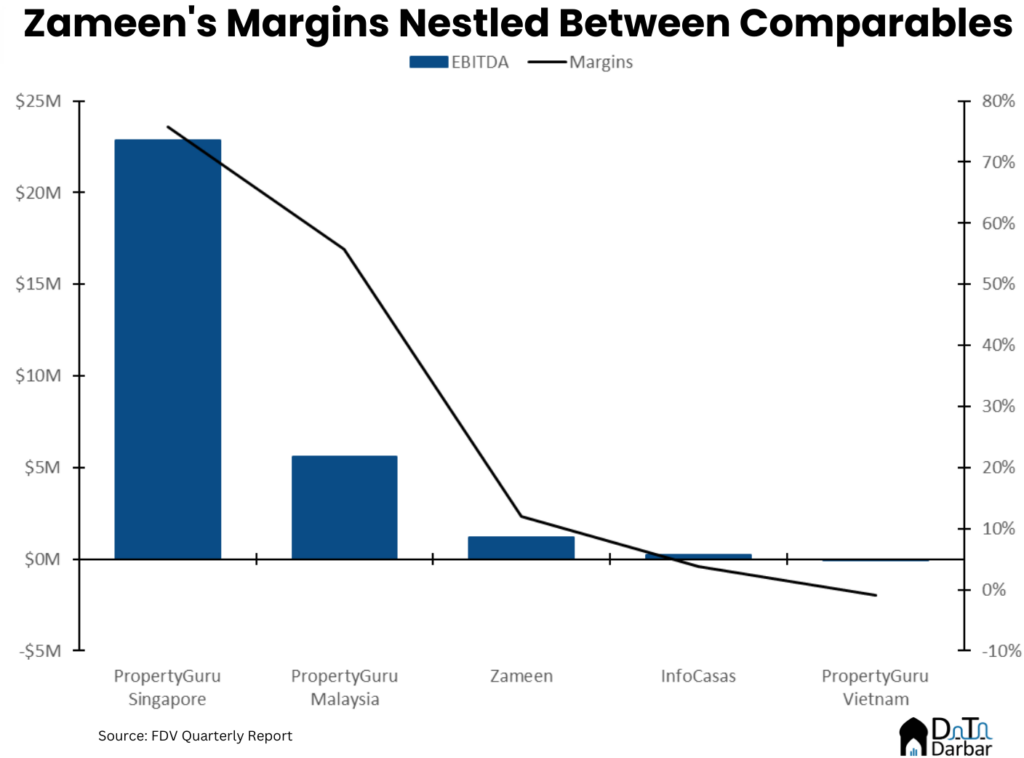

In terms of EBITDA, Zameen has also experienced a deterioration, falling one notch to the third place. However, when it comes to margins, the performance remains a little mixed. While it has ascended from the fourth to the third position, this improvement is attributed to PropertyGuru Vietnam, which went from 22.75% in 2022 to -0.87% in 1H2023.

Very interesting. Which Zameen vertical does your analysis cover, as they have multiple businesses e.g. development, marketing, design, web portal etc. I’m not sure whether there’s a holding company that holds all these companies.

These are overall revenues, of which the overwhelming majority comes from transactions i.e. developing and selling own properties. EMPG is the holding company but these are specifically Zameen’s numbers.