20 years. That’s how long it took Meezan Bank to become the most profitable bank in Pakistan and grow from from 60 people to more than 15,000. And in the process, brought Islamic banking from a niche into the mainstream. The story is a favourite of finance and stock market types, and for good reason. But there’s another story, much less known, of the rise of Meezan as arguably the largest digital bank in the country.

Meezan was an early adopter of technology, launching internet banking back in 2006 and mobile app in 2014. More than half a decade before Covid-19 really triggered the rise of digital financial services in Pakistan. This preparedness allowed it to quickly capitalize on the opportunity and become the biggest digital bank within the next two years.

Unfortunately, not a lot of historical analysis is possible as it was the first time Meezan gave (relatively) detailed information on digital channels. Earlier, there used to be scant data, apart from cursory mentions here and there. So let’s stick to the last two years, even if that gives too brief a trend.

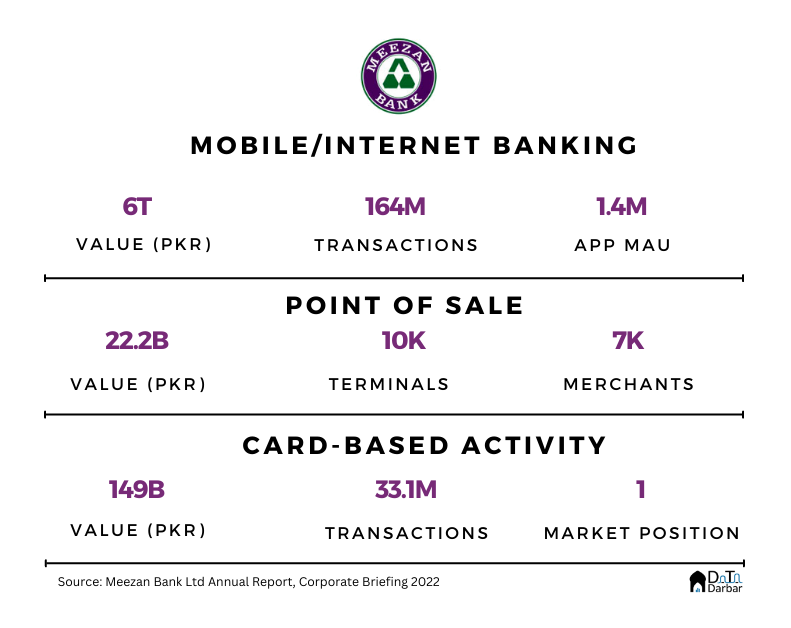

In 2022, its mobile and internet banking value surged 114.3% to PKR 6T, from PKR 2.8T the year before. This puts it miles ahead of the rest, with a gap of a comfortable PKR 1.8T between the next largest player! Similarly, the volumes soared 86.4% to 164M, compared to 88M.

As a result, average ticket size clocked in at PKR 36,585 during 2022, from PKR 31,818. This is lower than the industry level of PKR 41,762 during FY22 but still twice as much as HBL — the second largest commercial bank in online.

Dominating the Card-based Spend

The bank issued 487K debit cards on a net basis in 2022, taking the total to 2.8M. Their cumulative spend surged 90% to PKR 149B across 33.07M POS and e-commerce transactions, from PKR 78B and 23.48M in 2021. Consequently, the average value of a transaction rose to PKR 4,505, up from PKR 3,322. That’s higher than the industry level of PKR 3,902 (for debit) in FY22, as per Payment Systems Review.

Almost two-fifths of the total spend of PKR 149B was on e-commerce, translating into PKR 60.5B. This represents a growth of 74.4% compared to PKR 34.7B in 2021. The remainder PKR 88.5.B of value went through POS. This made Meezan the biggest player on this channel, in terms of debit card throughput.

It was also Meezan’s first full year in the acquiring business. In point of sale, it deployed some 10,000 machines across 271 cities which generated a throughput of PKR 22.2B during 2022. On e-commerce, the bank onboarded more than 300 merchants but didn’t disclose any transaction value or volume.

It’s all relative: Meezan’s share of digital

While the sheer magnitude of numbers is impressive, the performance looks even better in relative terms. Take this: 1.7M out of the bank’s 3M+ customers are subscribers of the mobile application. Of them, 1.7 M are ‘financially active’ — meaning they logged in over the last 30 days. From an app’s perspective, this is an exceptional funnel where 82% of registered users are monthly active.

At transaction level too, Meezan’s digital vs over the counter mix was pretty good, to put it mildly. For funds transfer, 91% of all volumes were digital by Q4-2022, up 10 percentage points YoY from 81%. In bill payments, the corresponding figure was 93%, edging up from 91.2% in Q4-2021. This means almost all transactions are already done through mobile and internet banking. [Note: the bank includes funds transfer received and bill payments from walk-in customers in the calculation.]

Technology Expenditure: doing more with less

Meanwhile, Meezan’s spending on information technology — one of the few leading indicators available — clocked in at PKR 2.78B. It represents YoY increase of 31.2%, with almost a third of the total allocated to software. But this is where the story gets really interesting because of how peculiar (and efficient) the bank is.

To begin with, its share of IT in overall operating expenses was just 5.93% in 2022 and has hovered around that level for five years. This is significantly lower than the industry average of 8.14% and was less than 19 banks during 2021. Even in absolute terms, eight banks had higher spending levels than Meezan last year.

Yet, their scale was far smaller. Basically, Meezan has managed a much higher digital scale in fewer money, and still outpacing industry peers in growth. That too off a higher base. This is probably the most incredible part of it all. Not to mention, the customers seem pretty content with the digital experience: their app rating has consistently stayed at 4.9.

To me personally, this story is equally exciting, if not more. An Islamic bank, with access to growing and granular deposits, delivering incredible growth in digital channels while being extremely lean. And should only add to the value investors attach to Meezan. But for that, the management will have to actively build the narrative.

Very well analyzed narrative Mutaher sb. Going forward if you have access to data, please do share regional best practices in this field as well. All in all, congratulations to Meezan team and to you for highlighting this. Regards

It’s perfect bank for All tractions and best service for All others bank now it’s going great job in Pakistan Pakistan no 1 best bank now days I am very happy with this bank

Amazing! Thanks for sharing, Great work

Yes no.1 banking in Pakistan…I want to work in this bank but I haven’t got an opportunity yet. I am an employee of Habib Bank and luck will give me an opportunity to serve here as well.Inshaalah

It also corresponds with the adoption of Islamic Banking by Gen Y aka millennials. And they were the best product when it was happening.

Brilliantly written. Well done mutahir. And what a remarkable achievement by Meezan. Truly a role model fr others.

Great read!

Sir I visited my nearest bank branch jahania for Apni bike application key leye my documents received misbah sb and he told me that I visited early after one month no response Aplicant name M.Aslam s/o m. Sarwar

I would like to appreciate the data provided which is amazing. Congratulations for achieving the goals.

Very good bank multan