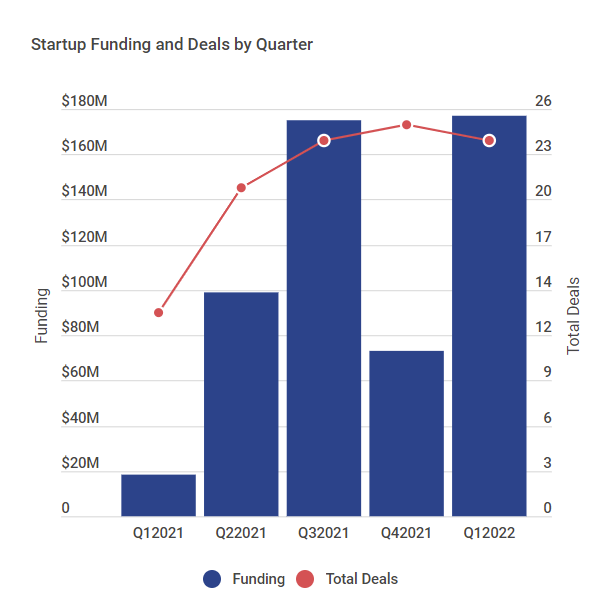

Pakistani startups had their best quarter ever as they raised a record funding of $177 million between January and March. This amount represented a whopping increase of 860% year-on-year compared to $18.5m in Q12021 and 142% quarter-on-quarter as against $73.3m in Q42021. It’s also more than $2m higher than the previous peak of $175m witnessed in Q32021.

However, the deal count slid a little to 241 in Q12022, from 25 in Q42021 while almost doubling from 13 investments made in Q12021. As a result, the average ticket size of a deal shot up to $9.8m during Q12022.

While the activity remained quite healthy overall, such a massive jump in the total investment could be attributed to a few large rounds as Bazaar’s $70m Series B, Retailo’s2 $36m Series A, and Jugnu’s $22.5m Series A which combined accounted for a little more than 72% of the capital raised. This naturally made e-commerce the most funded sector with total investment of $130m while fintech was a distant second at $25.3m with seven deals to each. Two rounds worth a combined $13.5m were also raised by transportation and logistics startups.

In terms of stage, most deals were seed at seven – raising $35.9m – and accelerator rounds3 with six. The latter was thanks to four Pakistani startups making it to Y Combinator’s W22 cohort while another three4 were part of SOSV’s MOX program. There was also a merger and acquisition as FindMyAdventure partnered with Bangladesh’s GoZayaan, hinting at the possible signs of consolidation in the ecosystem. Islamabad-based Walee also acquired UAE’s Mirrorr during the quarter but wasn’t included in the roundup due to its outward nature.

During the quarter, at least 71 unique investors wrote cheques to a Pakistani startup of which 10 were institutions that took exposure to the market for the first time. The most notable and biggest of these was Dragoneer Investment Group, a growth capital firm. Excluding the two accelerators, Zayn Capital was the most active fund with four deals, followed by Fatima Gobi Ventures at three while Indus Valley Capital, i2i Ventures, and Sarmayacar made two investments each.

Categorizing Pakistani startups by city, Karachi raised both the most money at $136.8m and the number of rounds at 12 while Lahore followed with $38.6m across eight deals. As for the gender diversity of the deals, there was hardly any since only two — Metric and Bryt — of the 25 startups had female co-founders while no female-founded business managed to secure investment.

Notes

- Investments have been included on the basis of when they were disclosed, not necessarily when they actually raised funds, to ensure consistency with announcements. For YC and MOX startups, the date used was that of their demo days.

- Retailo and Inventhub are headquartered in Riyadh and San Francisco respectively but were included in the roundup as Pakistan is for a major hub for them either operationally or commercially.

- Startups part of YC and MOX have been classified as accelerator rounds along with the standard deal they received as part of the program. If they club this money with funds from other investors to announce a bigger round, we will update the data accordingly.

- While Digikhata was part of MOX12, we excluded it from the roundup as its seed deal announced in 2021 already listed SOSV as an investor.

All the deals can be accessed here: