If you’re buying a car in Pakistan, there is only one website you’ll open for any information: PakWheels. The brand has become synonymous with all things automotive, a far cry from its beginnings as a blog where auto aficionados came together to quibble about the local scene. Today, Suneel Munj’s reviews command a cult following while the Pakwheels verified badge holds trust among customers.

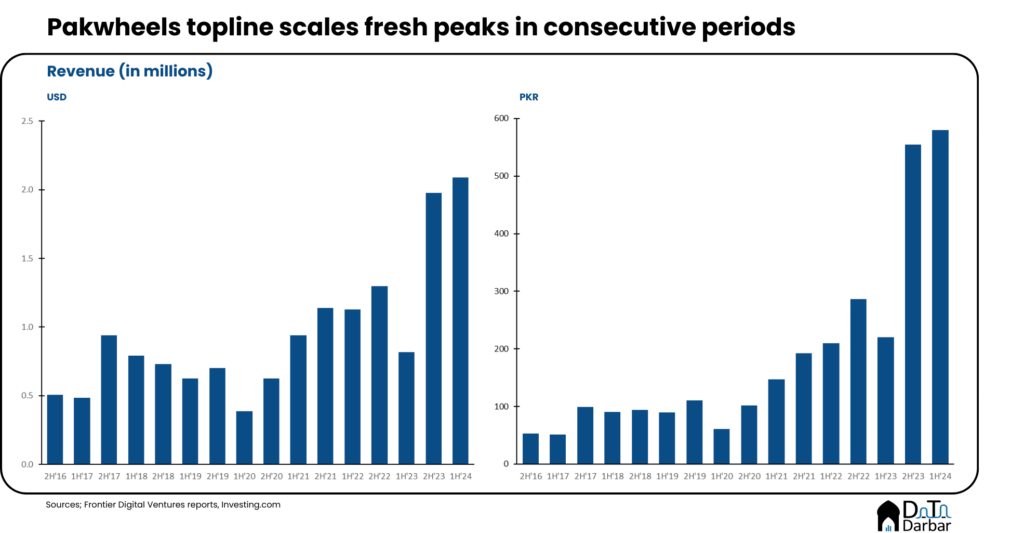

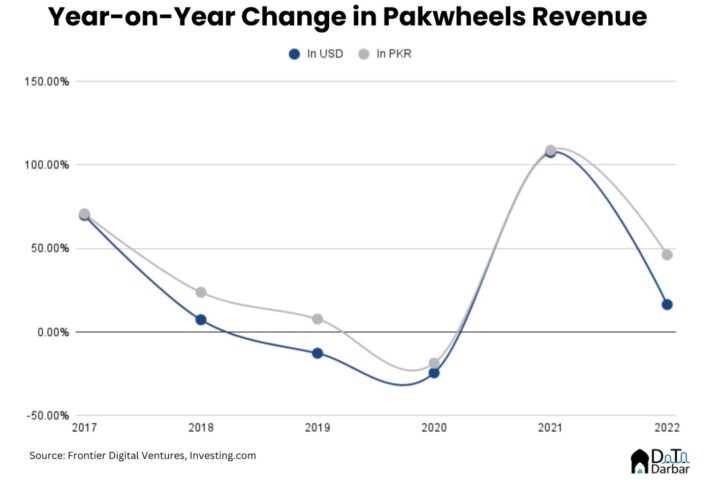

From a community and brand perspective, Pakwheels made it long ago. Many have tried and topple the monopoly, to no success. But as we have previously highlighted, scaling the revenues has proved to be more difficult for the management. Or at least used to be, because the company topline hit an all-time high during 1H’24.

New beginnings, new highs

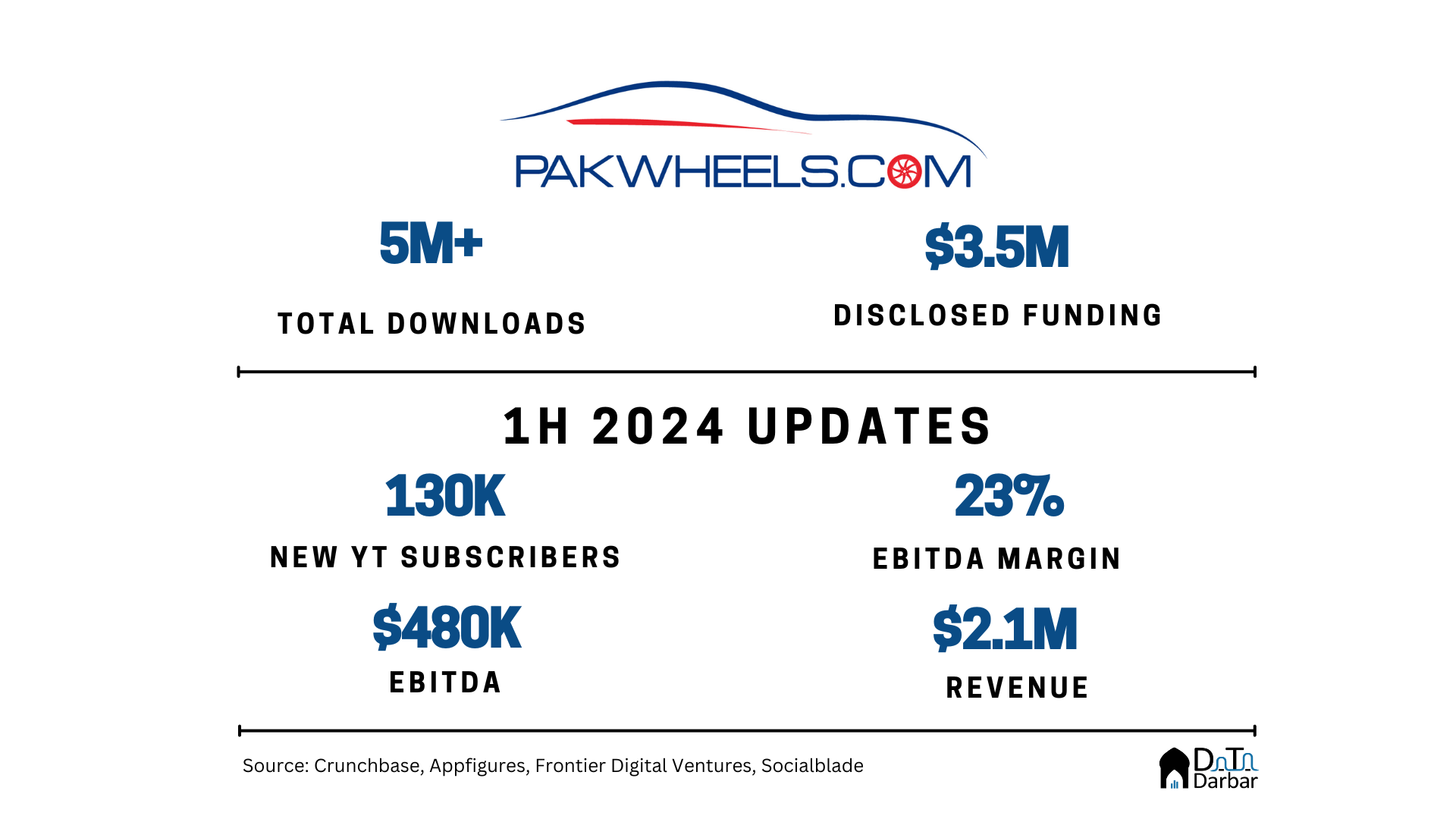

This performance came on the back of a strong 2H’23 when a low base helped revenues surge 141.71% YoY in USD and 93.8% in PKR. The momentum continued, with 1H’24 income at PKR 580.2M or $2.1M, up 163.3% in rupees and 5.76% in dollarized terms. The upsurge in topline marks a major breakthrough for Pakwheels as it had long been stuck in limbo.

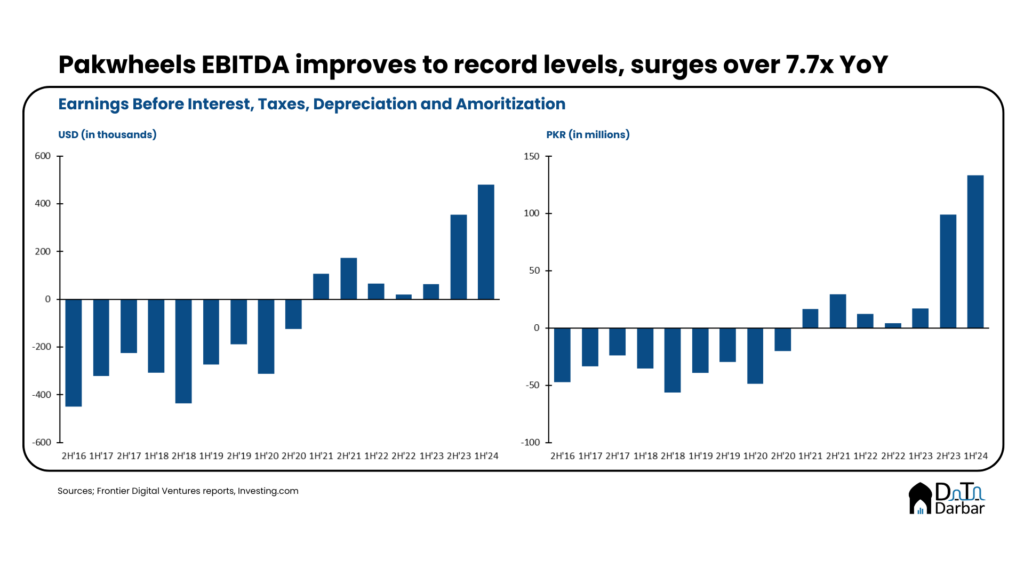

More importantly, the newfound performance extends beyond the topline. In 2H’23, PakWheels reported earnings before interest, tax, and depreciation of PKR 99.2, reflecting a staggering 487.9% surge over the preceding period. The first half of 2024 was more of the same as EBITDA reached PKR 133.3M. Translating this performance into USD, PakWheels’ EBITDA in 2H’23 exceeded $350,000, representing a 464% jump from $52,500 in the preceding half and then grew further to nearly $480,000 in 1H’24.

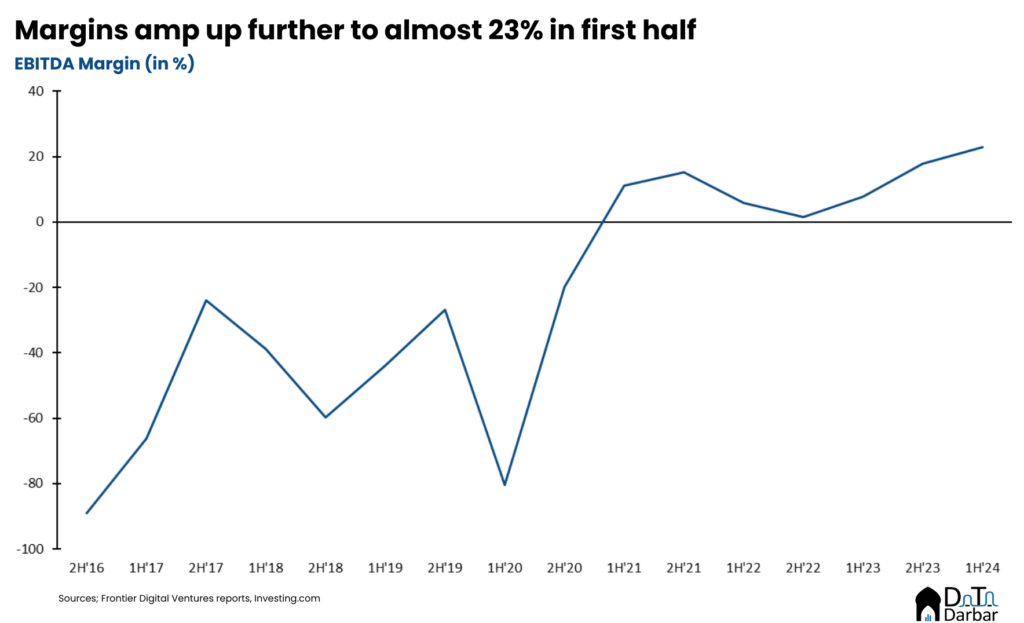

Along with growth in absolute values, margins have also shown recovery, rebounding to a robust 17.9% in the second half. This upward movement continued, as EBITDA margin climbed to over 22% during January-June.

Auto sector blues

What makes this performance more noteworthy is that Pakistan’s auto sector currently faces one of its worst ruts. According to Pakistan Automotive Manufacturers’ Association data, car and jeep sales were the lowest in two decades. The challenging macros, marked by currency devaluation and reduced purchasing power, have sparked a notable shift in demand from new to used vehicles.

As the primary destination for the used car market, PakWheels has strategically capitalized on this emerging trend, contributing significantly to the platform’s robust financial results. However, PakWheels’ ambitions extend well beyond its core offerings. The company has actively tried to tap into complementary avenues, such as finance deals, insurance services, and vehicle inspections. A while back, they also started doing transactions under “sell it for me”.

The social capital

PakWheels’ expansive reach is evident in the sheer volume of listings on its platform, totaling over 60,000 across Pakistan. The company’s strongest presence is in Lahore, which accounts for an impressive 13,579 listings. Not far behind is Karachi, with 11,313 listings. This strong presence extends across major cities, although Quetta lags behind.

To maintain that trust among users, the company leverages social media well, particularly video, and now boasts 2.32M YouTube subscribers across 729M lifetime views. On top of it, Pakwheels’ Facebook and Insta accounts have also done well, at 3.4M and 1.3M followers, respectively.

Peer Analysis

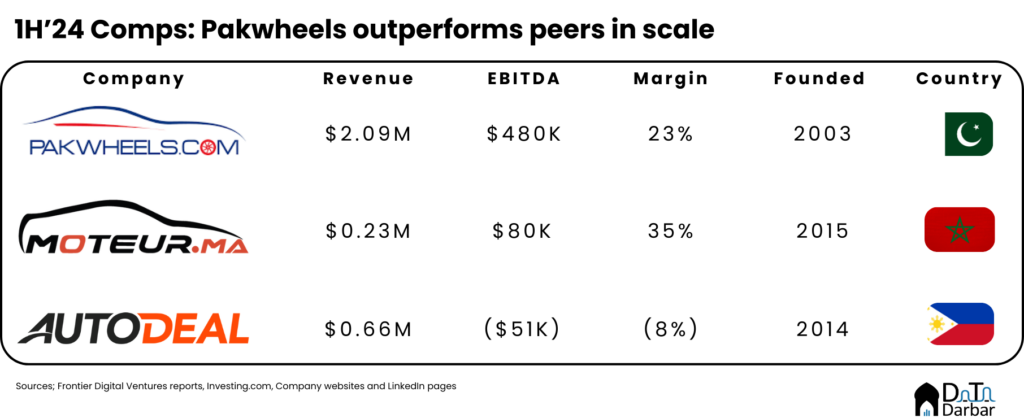

So we have established that Pakwheels has had a good run for 12 months now, exhibiting record growth and new peaks. But it’s obvious that at least part of it is coming off a low base. Therefore, we need to contextualize the company’s performance with respect to its peers. However, that’s quite difficult: locally, it’s practically a monopoly while the global counterparts either don’t have publicly available data or operate at a different scale.

Keeping in view of these problems, we limited our lens to two players: Autodeal from the Philippines and Morocco’s Moteur. Both are owned by Frontier Digital Ventures so their data is available. So how do they stack up? Pakwheels leads the way in terms of revenue with almost 3x the scale of the former and 8x compared to the latter.

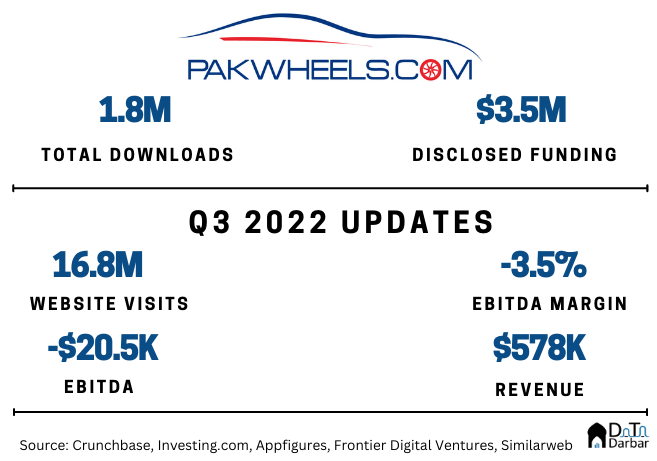

EBITDA tells a similar story where Pakwheels, at $480K, is well ahead of Autodeal’s negative $51K and Moteur’s $80K, albeit with higher margins. However, this has not always been the case. When we last did an analyst note, In both of our previous two analyst notes, Pakwheels had the most unenviable operating metrics despite a higher scale and more years of experience.

In fact, by Q2’23, even its revenue lead over Autodeal slipped to a mere $100K. But in the subsequent 12 months, things have changed considerably in not only increasing scale but doing so at improved margins. Of course, the problem there is that we are talking about EBITDA, which is not really a standardized metric defined by either of the two accounting standards, i.e. International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). That has never stopped tech companies from using it though. Maybe we should be thankful that they haven’t yet applied the community adjustment.

Very insightful analysis.A local peer comparison such as Car Dekho could have been added value .

Their numbers are too big to be comparable, hence we excluded it.