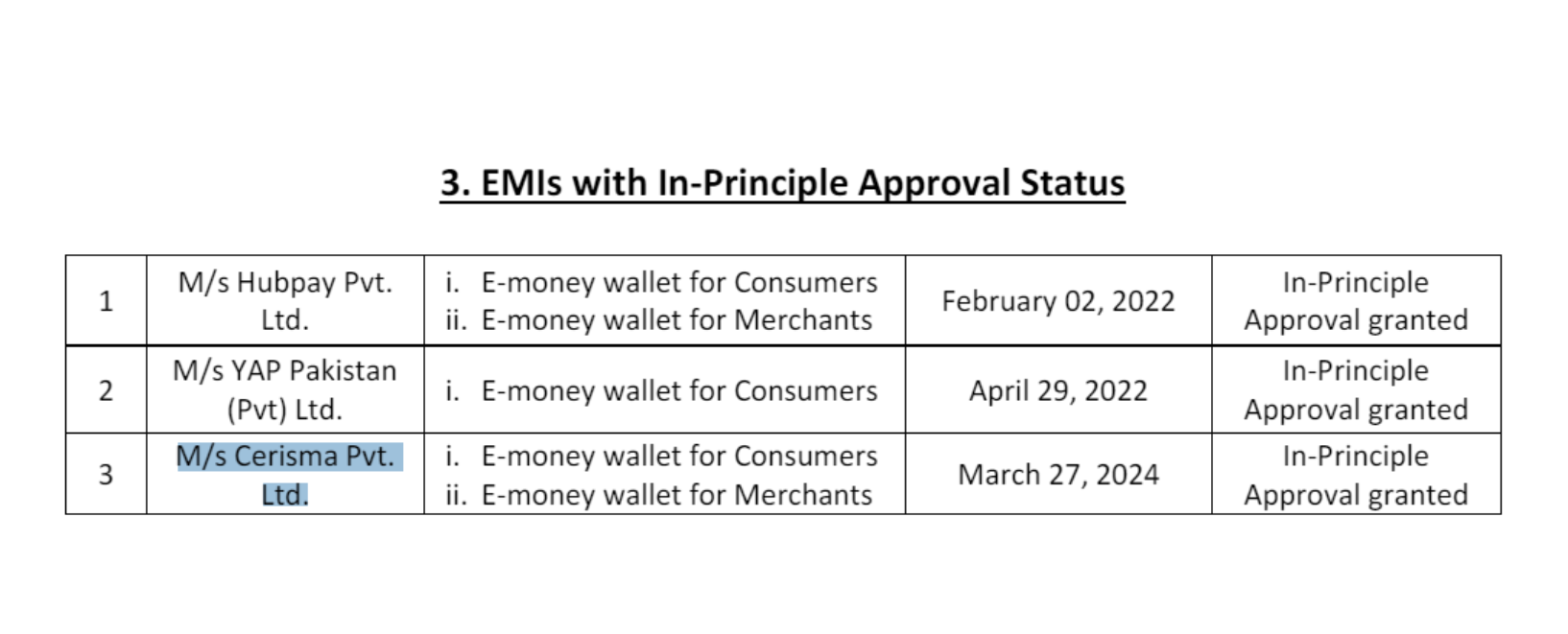

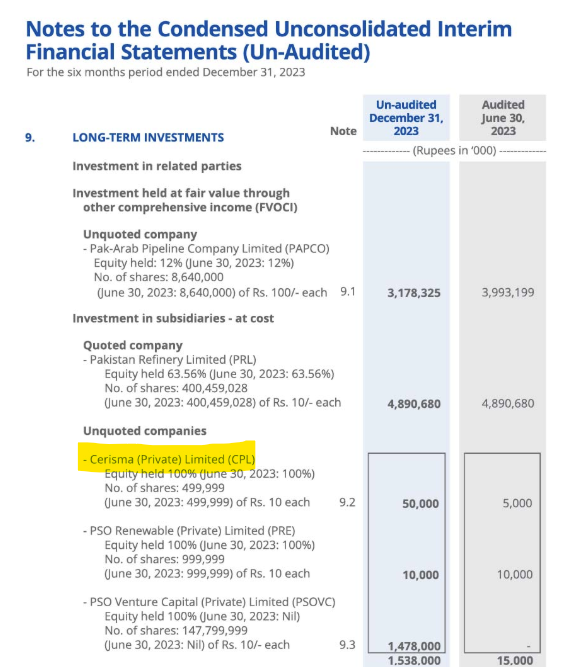

The State Bank of Pakistan on March 28th granted in-principle approval to Cerisma Pvt Ltd for operating an Electronic Money Institution. A subsidiary of the state-owned Pakistan State Oil, Cerisma plans to build e-wallets for consumers and merchants. This is part of the company’s diversification strategy, which also includes a venture capital fund.

This makes Cerisma the 13th entity till date to get IPA from the regulator though not all have remained in business. TAG’s license was revoked after it committed forgery, Careem and Checkout withdrew their applications and Finja sold the wallets division to Opay. In October 2023, even PayMax pulled out of the race despite live commercial operations.

Back in December 2023, Profit had reported in detail about PSO’s plans to seek an EMI license. While they didn’t exactly have any official communications regarding this, apparently the reason is to better manage cash. For context, the oil marketing company already has a closed-loop wallet.

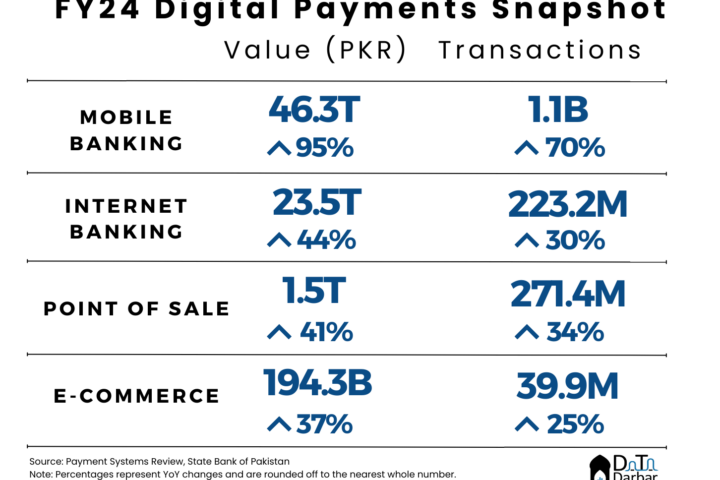

However, EMI is a step up in a couple of ways. For starters, PSO is among the larger contributors to point of sale throughput, where it pays 1.5-2% in merchant discount. As per another Profit piece, the state-owned oil marketing giant reportedly processed transactions worth PKR 18B on payment cards.

Taking these numbers at face value, PSO can potentially save a maximum of PKR 360M annually in MDR through its own EMI license. So purely by cost savings, numbers aren’t big enough to justify such an investment. I mean the leadership salaries and perks alone would eat up a large chunk of this. Hence, the core objective here has to be finding alternative revenue streams.

Now whether digital wallets can do that or not really depends. PSO already has a merchant network, which should definitely help uptake in theory. Similarly, a sizable customer base is open to paying by cards on pumps, so the user acquisition cost can be manageable too.

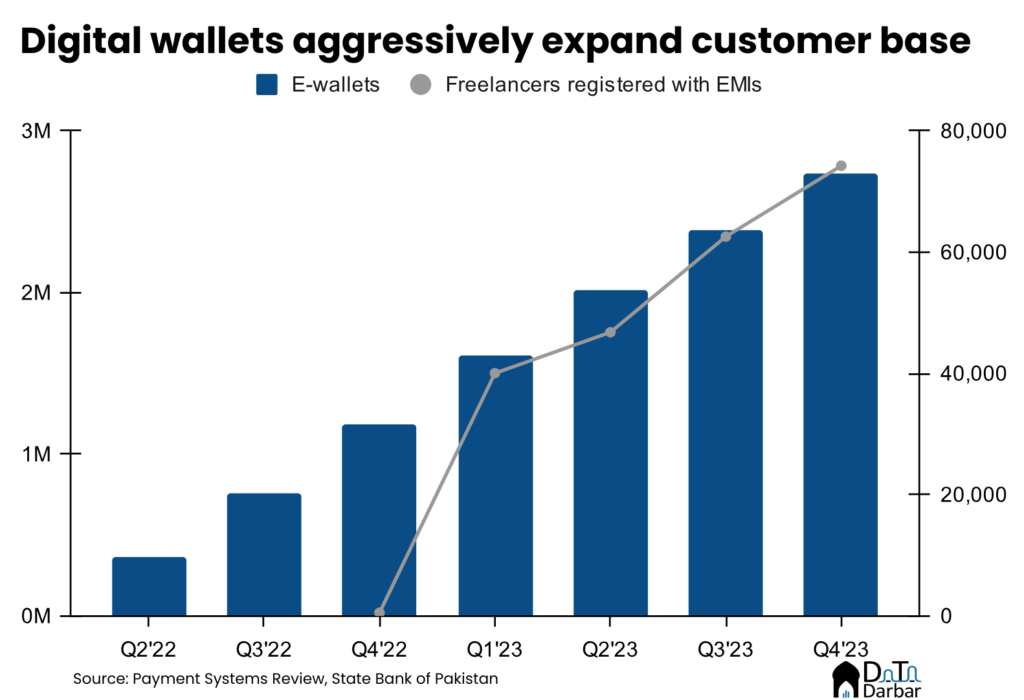

But with the ongoing exodus in EMIs, the strategy is nevertheless interesting. Despite that, the few commercially live digital wallets have managed to grow well. In 2023, they opened over 1.5M accounts in while onboarding almost 74K freelancers. At the same time, they processed throughput of PKR 138.8B across 57.9M transactions.

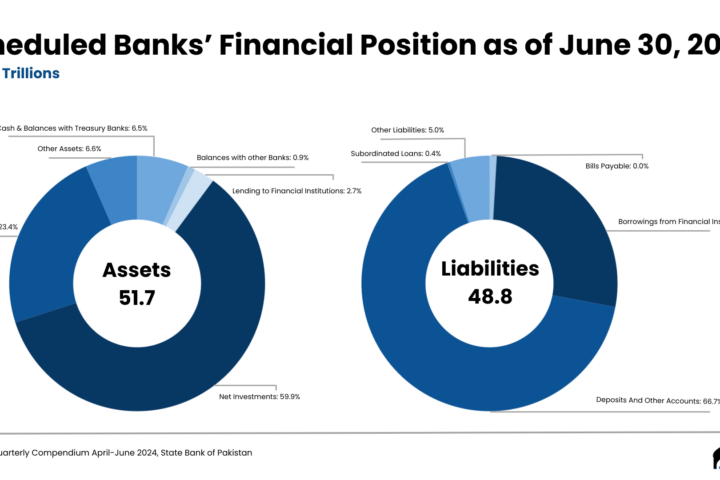

More importantly, the SBP made major amendments to the EMI regulations in mid-2023 and significantly expanded their scope by allowing additional services. But for a company of PSO’s size, it may still be a rounding error.