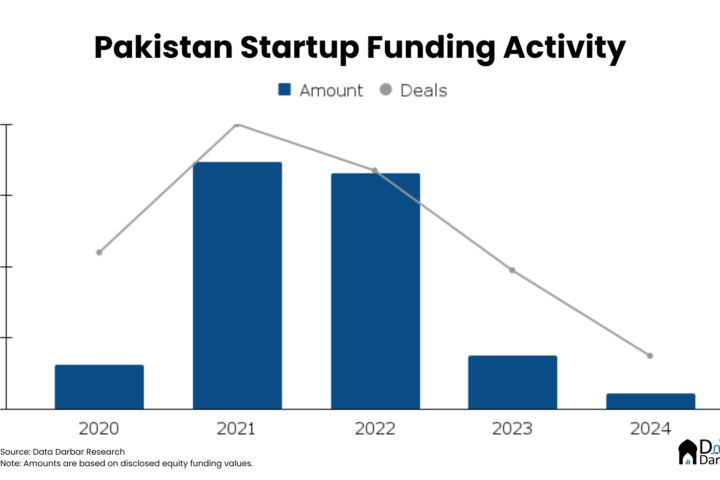

Sequoia Capital has joined the ranks of other VC giants like Tiger Global by making its maiden investment in Pakistan. They marked their entry by investing in Tania Aidrus’s DBank. The fintech reported raising $17.6M in what is Pakistan’s largest seed round.

Along with Sequoia, Kleiner Perkins co-led the round with participation from NuBank, Askari Bank, RTP Global, and Rayn. Sequoia Capital’s funding came from its $850M SouthAsia fund.

Founded by Khurram Jamali and Tania Aidrus, DBank wants to expand financial services net in Pakistan by taking on the usually exploitative informal credit system. Both co-founders were formerly employed at Google, working on the payments rail for the Next Billion Users initiative. Tania also had a brief stint as the Chief Digital Officer for the Government of Pakistan.

This is the single largest round by any fintech in Pakistan, adding to the sector’s funding tally of $53M in 1H2022. DBank is currently one of the many contenders for a digital banking license in partnership with Askari Bank.