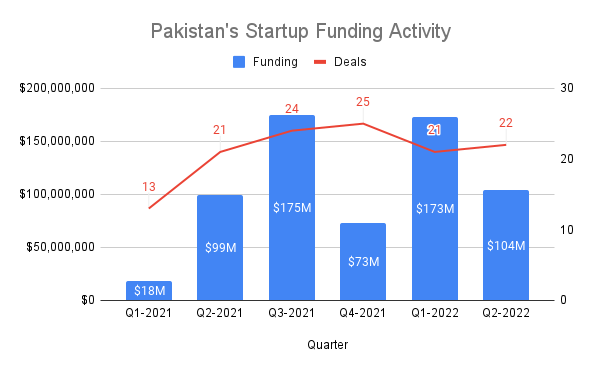

Pakistani startups raised almost $277 million in the first half of 2022, surging 135% from $117.6M over the same period of 2021. The number of deals also rose to 43, from 34. However, in Q2-2022, VC funding slowed down amid global macro tailwinds and pullbacks across markets, especially in tech.

As a result, investments in the second quarter dipped 41% QoQ to $103.8M, from $177M while the deal count stayed almost flat at 22. This pulled the average ticket size down 58% to $4.94M in Q2-2022, as against $11.5M in the preceding quarter. But compared to $99.2M in Q2-2021, funding still registered an increase.

Globally, venture investments hit new records during 2021 thanks to cheap liquidity. However, spiraling inflation and rates hikes by the Fed ruined the vibe, dealing a major blow to high valuations and outsize rounds that became so typical. Between March and May, VC funding slowed both MoM and YoY, reflecting a shift away from the olden days.

The correction in VC market has forced companies to reconsider their business models and cut costs. So far, 881 startups have laid off over 141K people with Pakistan being no different in this regard. In the past few months, a number of high profile players announced mass layoffs and pullouts from some services or markets. That includes Airlift, Truck It In, Retailo, Tazah, and Swvl, among others.

Seed funding under pressure

The slowdown has been most prominent at the late stage amid tech selloff in the public markets. As a nascent ecosystem, all but one or two deals in Pakistan are earlier than Series B so that impact can’t really be quantified. Instead, it was seed funding that saw the biggest decline, falling to $19M in Q2-2022, from $35.9M in the preceding quarter. This was the lowest amount at the stage since Q1-2021.

Funding at Series A also edged lower to $54M in the latest quarter, from $58.5M in Q1-2022. On a yearly basis, it jumped 52.7% compared to $35.4M in Q2-2021. On the other hand, pre-seed investments held strong, clocking in at $8.2M – up both QoQ and YoY.

As usual, e-commerce was the most funded space with $42.6M raised across 5 deals. This took the sector’s YTD total to $172.1M and 11 deals, driven predominantly by the four big rounds of B2B marketplaces. That is Bazaar’s $70M, Dastgyr’s $37M, Retailo’s $36M and Jugnu’s $22.5M. In fact, those four cumulatively account for almost 60% of the half-yearly investment in Pakistan. This is part of a broader trend of B2B dominance. In 1H2022, the segment raised over 71% of all the capital deployed in Pakistan.

Fintech startups managed to raise $27.9M across three deals in Q2-2022. While the amount was up both QoQ and YoY, the number of deals was actually the lowest since Q1-2021. Meanwhile, transport and logistics maintained its third place, picking up $14.6M in the latest quarter via six deals.

City-wise, Karachi topped the charts by a margin: $90.9M across 19 deals, putting its share in total funding and deals at 87.6% and 81.8%, respectively. Meanwhile, Lahore raised just $1M in a single round (24Seven.pk), the lowest total since Q1-2021. Meanwhile, only one deal each was raised by female-founded and co-founded startups: meqIQ’s $1.8M and Outclass’s $500,000. There was also an M&A deal during the quarter, with Swiss-headquartered Zoodpay buying Tez Financial.

Excluding accelerators like Chinaccelerator or Y Combinator, the most active investors in 2022 were i2i Ventures, Fatima Gobi Venture and Zayn Capital with 5 deals each. Indus Valley Capital, Sarmayacar and Germany-based Reflect Ventures followed with 4 deals each. There was also some activity from the local corporate sector as Systems made two deals through its venture arm, as did the House of Habib while United Distributors Pakistan also invested in a startup.

Here’s the complete deal flow for 2022: