It’s okay guys, everyone can rest easy now. Women’s day is finally over so you can close that “quotes by strong women” tab and move on from the virtue-signaling on LinkedIn. I know it was hard for all the poor men out there to put a pause on blowing their own superiority horns for one single day to talk about women in tech who are “doing it all” but it’s okay. It’s over. Women’s Day passed off without a hitch (and any real meaningful change for women anywhere) and we’re back to our regularly scheduled programming.

The celebrations were of the usual nature. Employers talked about breaking the glass ceiling, social media interns worked overtime to scourge women from all over the company for cheesy posts about resilience and of course organizations actively barred employees from attending the Aurat March (in case women get some misguided notion in their head that this day is actually going to change something for them).

So while my LinkedIn feed was full of gift baskets, I got to wondering if tech spaces have improved at all for women. Given that no companies announced any radical changes pertaining to maternity leaves, workplace harassment laws or did anything to bridge the pay gap, I guess we’ll just have to drown our sorrows in the bottom of our tokenized LAL’s gift baskets (or dairy milk bubbly basket depending on how much your boss loves hearing you thank him on social media)

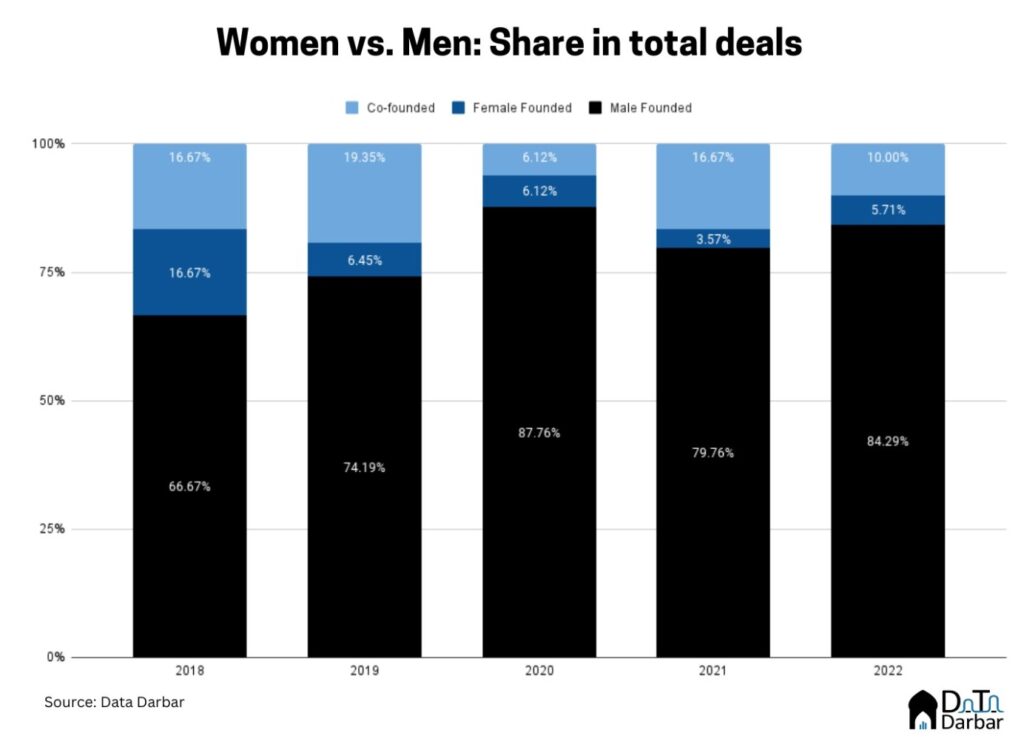

You would think that things would fare better in the startup space — the bastion of forward-thinking but turns out that the startup ecosystem too is a boys club. I mean, the overall gender ratio in Pakistan’s tech sector is just 17%, which comes down as you move up the hierarchy. By the time you reach the founders, the disparity is glaringly obvious.

Girls just wanna raise funds!

A quick glance at the investment data gives a pretty damning picture. Sample this: of the $831.2M raised by Pakistani startups between 2018 and 2022, female-founded companies got only $9.8M — or just 1.12%. During this period, the ecosystem has basically witnessed three different cycles — from the early irrelevance to the post-Covid capital frenzy to the downturn.

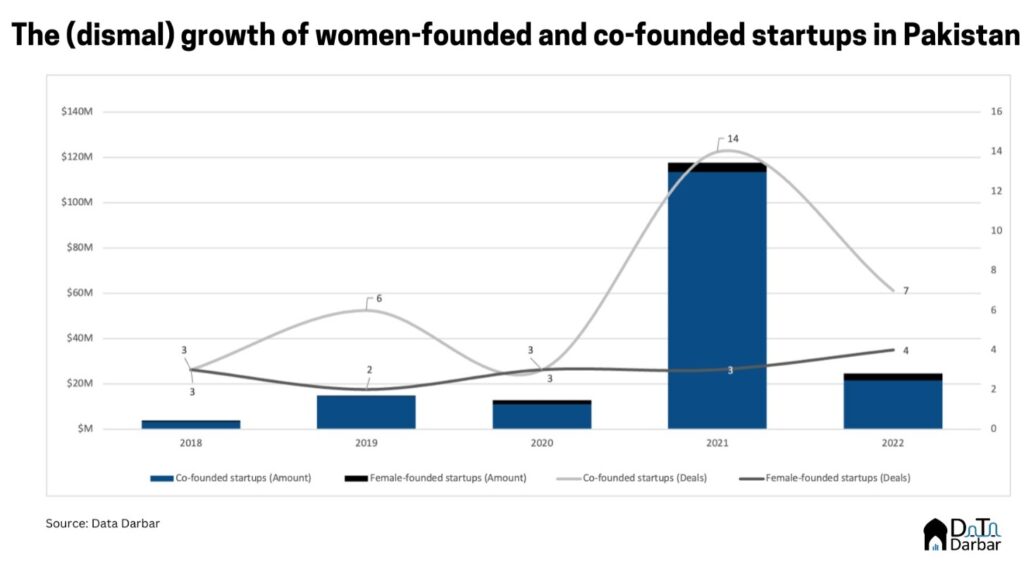

But for women-led companies, it’s been just one constant dry spell. Their share in overall funding dipped to just 0.88% last year — breaching an already low benchmark. In absolute terms, they have managed to raise more capital though, growing from $600K in 2018 to $3.05M in 2022. However, the deal count has effectively remained flat.

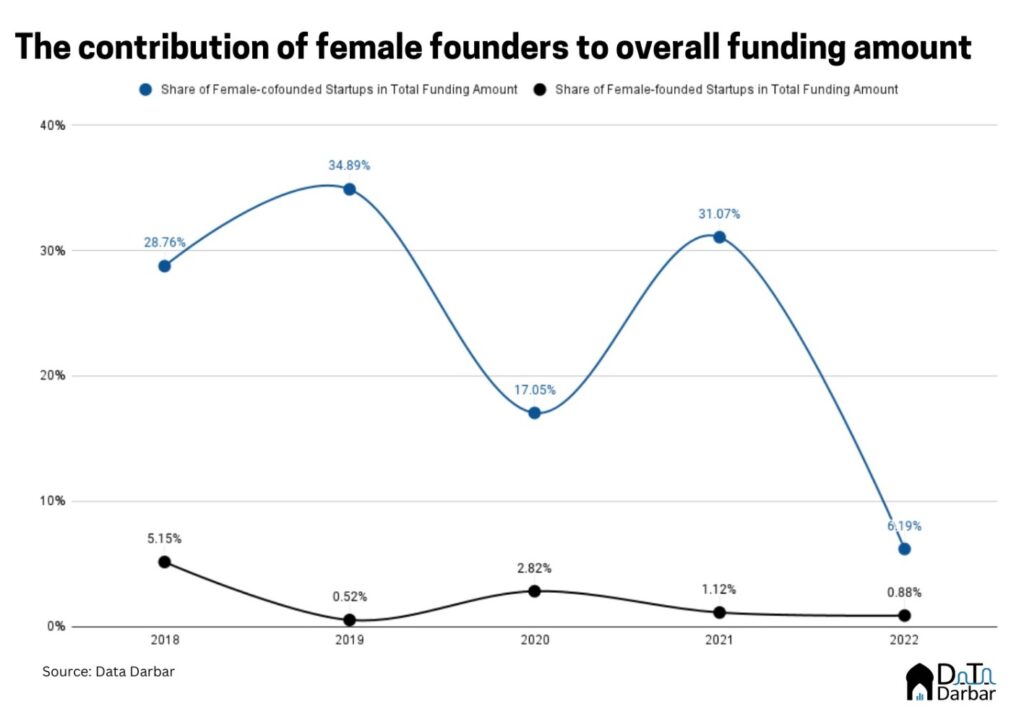

Meanwhile, companies with women co-founders have fared relatively much better with $164M raised during the five years under review. That’s 19.7% of the total funding into the country. Investment in female co-founded startups rose from $3.35M in 2018 across 3 deals to $21.5M (7) in 2022.

Impressive, right? Well, kind of. But if you dig deeper, there are some underlying issues. For example, excluding Airlift, that share falls to just 7.6%. That effect is also reflected in dollar value too where the now-defunct startup literally carried the funding numbers of female co-founded companies. To be fair, that is part of small ecosystems like ours so let’s move on.

In relative terms, the share of dollars allocated to female co-founded startups fell to just 6.2% last year — almost a fifth of where it stood in 2021.

Ticking off the “at least one female founder” checkbox

Another possible caveat with such companies is regarding the actual decision-making power. Having a female co-founder in itself may not necessarily be enough. Why? Because at times, it can be driven in large part out of optics and ticking boxes. After all, having women leaders in your team can help you stand out from a diversity point.

One (imperfect way) to look at the decision-making power is to see the gender of the chief executive. And that’s where we see a clear trend. Of the 26 unique female co-founded startups that received funding between 2019 and 2022, only 7 had women CEOs. Of course, the ideal metric would be either the shareholding or the voting shares, but well, we can’t get everything.

One look at the chart and you’ll see how incredibly bad the numbers are. Can’t seem to find the bars for women-led startups? Don’t worry, it’s not a glitch, just that the funding raised by women is so less compared to co-founded startups that the visualization becomes almost a blip. And we are already looking at the two relatively worse-off segments. If you plot capital allocated to male-founded companies in the same graph, it would basically be incomprehensible.

Global unity against funding female-led ventures

To be clear, this is not just a Pakistan phenomenon, but rather a consistent feature of venture capital across markets. Even developed ones. For example, women-led startups in the US received 1.9% out of the $238.3 billion in venture capital allocated, according to PitchBook. European founders did not fare any better with only about $1.1B invested in startups founded or cofounded by women. In percentage terms, their respective shares in overall funding stood at 1.6% and 17.8% in 2022.

Another interesting observation to note is how women-founded startups are rare in more investable sectors such as fintech and e-commerce. Of all the female-led startups that raised funding during 2018-2022, healthtech led the charts at $4.3M across 4 deals. While fintech did follow with $3M, it was singularly thanks to Oraan’s seed round.

Are female VCs going to be the saviors of female founders?

But why exactly are female founders still lagging behind their male counterparts when it comes to raising capital? There are some structural explanations for this, beginning with Pakistan’s low levels of female labor force participation. This gap amplifies further in technology and financial services — two sectors most relevant to attracting VC.

One reason could be attributed to VCs wanting to put their money on someone they can relate to. Seeing as how a disproportionate majority of VC firms comprise men, it’s no surprise that they are opting for male founders. While the solution to this may seem like an easy fix brought about by getting more women involved in venture financing, recent research showed that it was harder for female founders to raise additional rounds of financing after getting initial capital from female investors.

Investor bias focusing on the sustainability of women-led startups might also be a good reason behind the gap. Investors often operate under the bias that female founders are focusing on their startups only until they are pulled into family roles, after which their time & commitment to the venture may dwindle. This not only stands true when it comes to funding but women are also evaluated upon this criteria when applying for jobs. So the next time you see your friendly neighborhood investor talking about how WOMEN CAN HAVE IT ALL, just know that the same multitasking skills that women are often lauded for can also serve to perpetuate a bias against them.

The holy grail of diversity, representation, and social enterprises

While VC is undisputedly far less accessible to women, this doesn’t mean there are no capital avenues. For an earlier unpublished study [2013-2021] to track grant funding for women entrepreneurs in the country, we took a sample size of 85 female-founded and co-founded startups from Pakistan and found some interesting insights. For example, of the 36 all-women-led businesses, 17 had raised grants while another 7 went for a mix of both VC funding and grants.

The latter includes Oraan and Sehat Kahani, two of the better-funded female-led startups from Pakistan. Only 10 had exclusively relied on VC. Anyway, notice how the base is bigger in comparison here. 36 companies accessing capital versus 15.

While grants are a good source of (often free) money, they are not necessarily alternatives. It’s about time VCs put their money where their mouth is and start trusting women founders. Not just so they can boast about their diverse portfolio at the next panel but because it could boost their returns. A 2018 Mass Challenge study found how women-led businesses gave higher returns, were more capital efficient, and yielded positive bottom lines over time.

TL:DR: Fewer panels and conferences and networking events on “supporting women in tech” and more giving money to women in tech.

this is SO well written i was cracking up in the beginning and then i just felt depressed

We may also account for the possibility that female founders in Pakistan don’t have as much business sense and street smartness as their male counterparts do? This is not a misogynist statement. It’s just a reflection of how things are in this country: well before they enter work lives, boys from urban educated middle class and elite (the kind that usually make up founders) are exposed to business, economics, commercial deals and so forth. Be it going to the market twice a day to get groceries; hanging out with boys’ late night sipping tea and discussing plots, stocks, and other side hustles; or be it passive learning courtesy exposure to conversations with family elders about business, economy, commerce, jugaars, hacks, commercial frauds and so forth. The girls who do are exceptions rather the norm. Second, given the very nature of startups, both world over and Pakistan in particular, successful founders are those who are good at networking, hustling, getting close to who’s who. Hence it may be so that female founders are not only unable to convince investors with market potential but also perhaps don’t have the required business, trading, mindset and skills as to how to hack the system and raise funding. It is this gap that must be addressed – and rightly so – first before female founder can claim equal right to funding.

Thank you for writing this!

Wow, that was a witty yet factual article. I really enjoyed reading it

It’s a great sign of progress in Bangladesh’s fintech scene to have Sadaf Roksana, co-founder and executive director of Nagad, leading the way. Kudos to first female fintech founder in Bangladesh for breaking barriers and making an impact.