Bankers get a really bad rep in Pakistan. The government doesn’t like them and has been wanting to do their koonda for a while. Except for a handful of “analysts” in the media, journalists have no soft spot for them either. Neither do consumers and businesses — basically anyone who has ever stepped inside a branch. Now even the International Monetary Fund has joined the club, of which I myself am a card-carrying member.

But my theory is that deep down, we all are actually jealous of them. Just think about it: the guys in the head office are posting growth across almost every metric that matters to the leadership. Deposits? Of course. Profits? Duh. Does it require much effort? Perhaps not, inflation helps big time in meeting the targets, which in turn earns those bonuses and foreign trips.

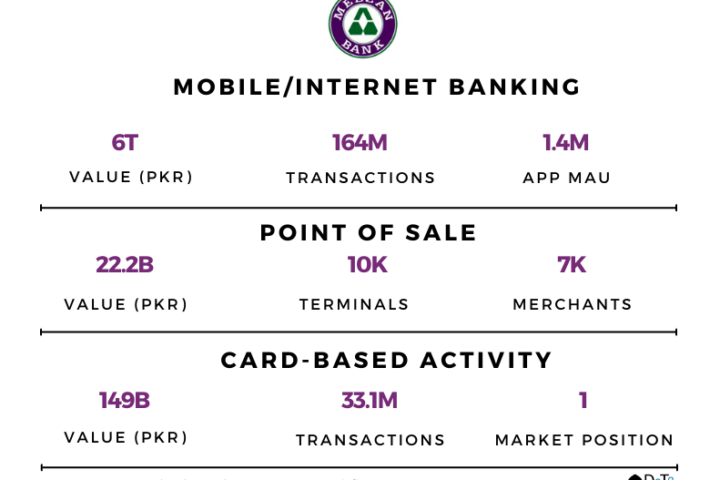

So less work → more money and career progression? Sounds like a pretty deal to me. Do the rest of us like it? Well, they don’t care. It’s not just about profits. The same story applies to digital banking: talk to any person and ask about their experience and usually, the answer wouldn’t be affirming. Some might not be able to get e-statements from the app for a period longer than the last 60 days. Others may complain about recurring biometric problems, until a contact at the head office helps out.

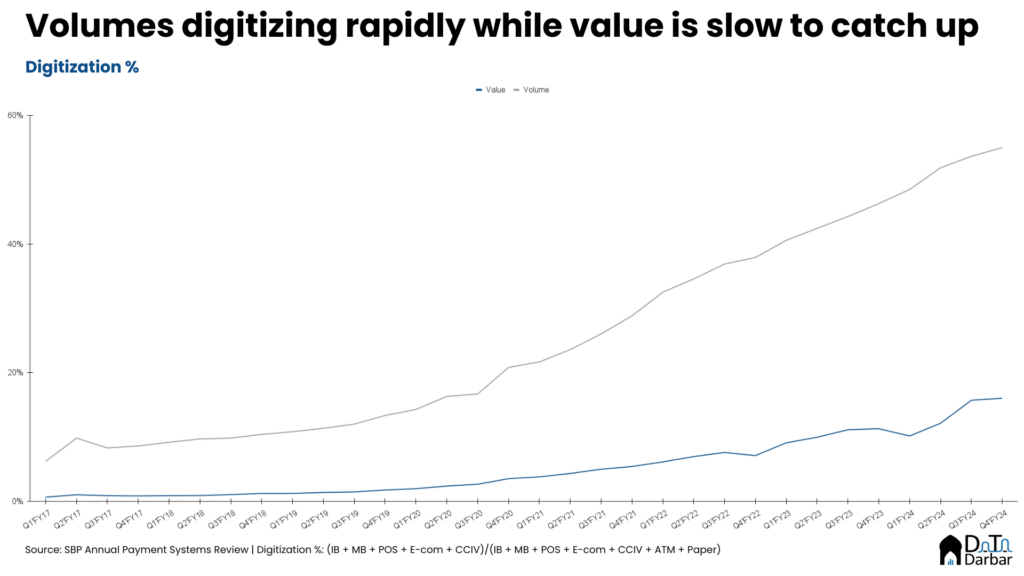

Yet, scheduled banking transactions are digitizing at a rapid pace. In FY24, 52.4% of all volumes were already digital while the corresponding share in throughput was a much lower 13.4%. If you go by the SBP definition, which also includes ATMs, the figure would be even higher. However, this is only part of the story as the number doesn’t capture the exchange of money outside the formal financial system. Ideally, that should be the denominator to truly understand how much have payments digitized in Pakistan.

In absolute terms, which is probably what these guys would be more concerned with, the picture looks even better. Those who have followed the SBP Payment Systems review already know the story well. Mobile banking was both the biggest and the fastest growing channel, with throughput of PKR 46.3T while number of transactions breached the billion mark to reach 1.5B. We did the update for FY24 to contextualize the key numbers, which you can read here.

Payments valuations

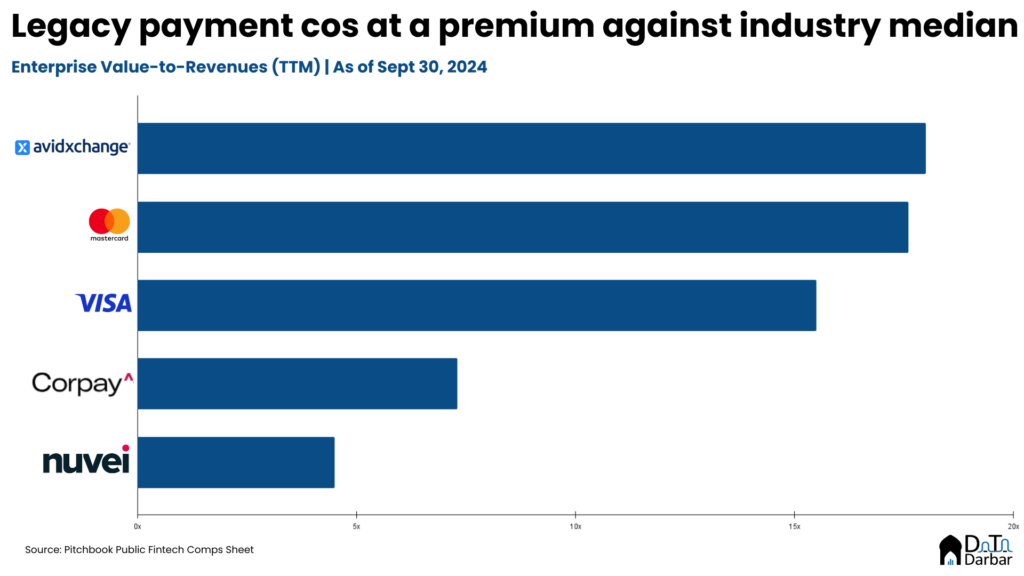

While we are on the topic, listed payment players have also had a good run on the markets so far. High growth companies, such as Ayden, had a median return of 14% in 9M’24, lagging behind the category medium-growth & legacy, which includes the likes of Mastercard, at 28%. However, the trend was different in terms of valuation with the former trading at EV/EBITDA of 14.5x as of September end, compared to the latter’s 9.9x, as per Pitchbook data.

Payments funding woes

On the other hand, funding activity in payments was more mixed. Though investment of $1.4B across 111 deals represented a growth over the same period previous year, low base had a big role to play. Compared to the peak of $11.3B in Q4’21, the dollar value is down 87.5%. However, this is a much wider problem that extends to not just fintech but venture as a whole. In fact, payments still dominates fintech funding with a share of 19.4% in dollar and 14.7% in the number of deals.

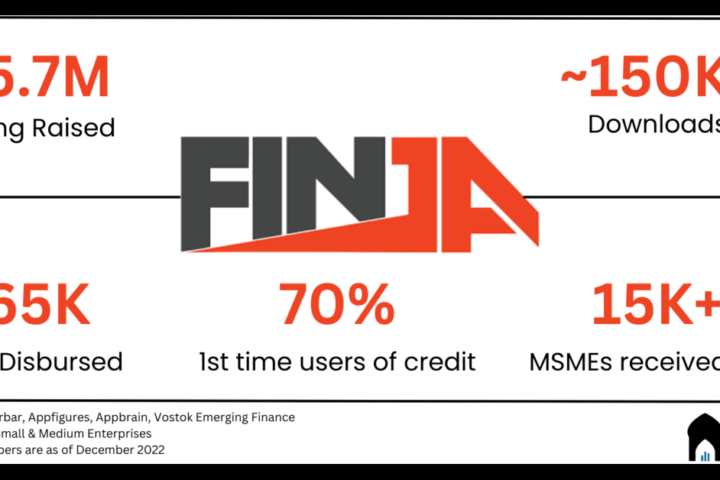

For Pakistan, this is futile exercise as there have been hardly any deals this year, that too in payments. However, the vertical traditionally used to dominate the funding activity in fintech, until lending took over. There are many reasons, including the fact it’s incredibly hard to make money from processing transactions unless you add a credit layer on top of it. So as investment dried up, maybe the unit economics of payments became less attractive to investors.

More importantly, it’s a very patient game with right regulations and long timelines. Getting approval for commercial operations takes years where you earn no revenues while still incurring heavy costs to meet regulatory requirements. In the current venture environment where investors are already on sidelines, this is yet another layer of risk. On the other hand, you can obtain a non-banking finance company license relatively quickly, where the gap is arguably far bigger. That could possibly explain why we are seeing a healthy flow of lending startups, some of which, like QistBazaar and PostEx, recently raising as well.