As children do you remember your TV viewing experience being marred by those repetitive home shopping network ads? Sometimes it was an instant weight-loss belt while other times it was a magical vegetable chopping tool that the host (and your mother) were constantly fawning over. In any case, with a discount-driven call to action to drive up the excitement and constant repetition to echo the message across, the home shopping network ads were a highly effective (albeit annoying) selling channel and are very well the ancestors of modern-day live commerce.

Though the platform of choice might have changed from television to the internet, live commerce is making a slow yet steady comeback. According to a McKinsey report, the channel will account for 10-20% of all e-commerce by 2026.

Alibaba and Live Commerce

It was Alibaba’s Taobao Live that brought the channel into the internet age, back in 2016. A report by the Academy of China Council for the Promotion of International Trade found that livestream shopping reached 469M users by June 2022. That’s 45% of the country’s total internet users with a projected market size of $726B by 2023.

Understandably, the model’s success in China has made Alibaba-owned Daraz extremely bullish on live commerce. In 2021, the company launched its live channel with the acquisition of T20 Cricket World Cup streaming rights. And it was a huge hit: their monthly active users rose from 6M to 15M. By November 2022, they had hit 27M MAU, as per Ali Rizvi, Head of Affiliate Influencers & Live Commerce at Daraz Pakistan.

They have built an in-app live functionality on the Daraz app where users can browse through products added to the live stream. Customers can then avail additional discounts, add items to their cart, and order through the livestream itself. In 2022 alone, the company reportedly did 7,500+ streams, working with 400+ brands and 100+ influencers for non-sports campaigns.

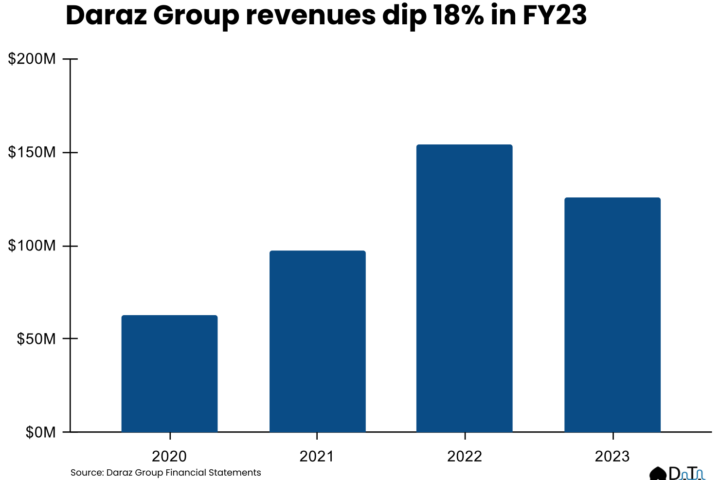

What do the numbers say?

But what makes them and others so bullish on the channel? According to Mckinsey, companies using live report conversion rates of up to 30% — 10x higher than that of conventional e-commerce. Daraz itself claims an average watch time of nearly 13 minutes and 70% engaged users. As per Ali, they have seen a 7x uplift in orders during 11.11 and 2.5x in 12.12 campaigns.

Similarly, Bagallery has also been pushing ahead with the channel. “We have experimented with Instagram Live, shoppable, and billboard live sales, out of which the winner is the Shoppable live sale that we do on our website,” according to Maira Rehan, Live & Social Commerce Manager at Bagallery.

“Our average sales increased by 1.8x and the average order value was 1.5x compared to non-live hours,” she adds. This is a sentiment echoed by Daraz, who has found that shoppable live-commerce provides better returns than other platforms.

Will live shopping take off in Pakistan as it did in China?

However, according to Zubair Naeem Paracha, founder of Menabytes and Flare, the picture with live commerce is not as rosy. “I don’t think we’re going to see anything remotely close to China. What we’ll probably witness would be similar to how it played out in India. There have been multiple startups and even some leading e-commerce companies that tried it and haven’t had much success yet.” Even Meta pulled the plug on its livestream shopping feature in September 2022 after it failed to generate enough uptick in orders.

“In China, live commerce is driven by KOL or influencers. They’re usually brought by large e-commerce companies who have a lot of cash to spend on those campaigns and eventually the influencers who convert end up with really good earnings,” adds.

“When you look at Pakistani influencers, they would never want to be part of anything that’s based on performance. They are always interested in deals where they make money by putting a picture or video up on their Insta or TikTok without worrying too much about what kind of engagement it brings. So they wouldn’t want to do these live shopping sessions where their payout is tied to results.”

The (not so) rosy picture for the future of live commerce

Then there are some more structural reasons facing the takeoff of live commerce in Pakistan. For example, the channel relies on high-speed internet, which is scantily available here, says Paracha. “Also, due to low disposable income, the majority of the population does not shop impulsively. And the entire concept of live commerce relies on that,” he adds.

There’s some weight to the pessimism in this view. As per a post from Daraz’s COO, the company did only 25,000+ direct live orders worth $200K across South Asia. Admittedly, the numbers were substantially higher for guided orders (1.2M+ and $30M+), but probably not enough to justify the many costs of building and sustaining the channel. I mean, they have been buying rights to stream literally every major cricket tournament and series in the region.

No country for live commerce tech

Market dynamics aside, one reason why live shopping may not be such a hit in the country could be the expensive tech options. “Barriers to entry are two-fold: if you are planning to do streaming on social media, the lack of live shopping features (e.g. in the case of Facebook & Instagram) limit their effectiveness,” says Saad Mughal, the co-founder of AlphaVenture.

“Meanwhile, pre-built, easily integrable live commerce solutions are available but quite expensive with major providers based out of the US or Europe. Given the devaluation of the rupee, these solutions are accessible only to the big players while the mid-to-small e-commerce stores are still in the dark,” he adds.

“Similarly, building your custom tech for live is prohibitively expensive because of the time, effort, and cost. Again, something that is impossible for mid-to-small e-commerce companies to do with their limited-to-no technical resources at hand,” continues Saad.

While Daraz is undisputedly the most vocal proponent of this channel in Pakistan (and the most qualified to run this show given the success of their sales campaigns), most growth in live might come from small social media-based brands. But before that, shouldn’t we first think about cracking e-commerce 1.0 first?.