It’s been over a week since the cricket World Cup ended and we are still reeling from the after effects. Depending on where one’s loyalties lie, the results spark very different emotions. Indian fans are understandably heartbroken after their team, coming on the back of an unbeaten run, failed to perform on the most important day while the rest of us are enjoying their loss. To the champions, Australia, it’s just a habit by now. But for those in the business of broadcasting and streaming, it was a bonanza regardless of personal loyalties.

Like all forms of content, cricket too has seen a strong shift away from television to OTT platforms. And the money is also flowing in the same direction as evidenced by IPL streaming rights selling at a higher price than broadcasting. For streaming platforms in the region, it’s perhaps the biggest season of the year by a huge margin. Well, at least in South Asia. This rings especially true in Pakistan, as we highlighted here over a year ago.

But how important cricket season really is for the OTT platforms? Not just any season, but the ODI World Cup. Despite all the qualms about the format’s future, it remains the biggest tournament of the sport which no T20 trophy or league can yet match. We decided to look for the answers and analyzed 13 unique apps that were streaming it. [Note: Bangladesh’s Toffee wasn’t part of our sample due to data unavailability.] These products were spread across continents, from 9Now in Australia to Sky Sports in Europe.

Stacking up the numbers

Over the course of the ICC WC’23, i.e. between Oct 5 and Nov 19, the streaming platforms in our sample were installed 31.5M times, according to Appfigures estimates. Understandably, the majority came from India where Disney+ Hotstar accumulated 21.6M downloads. Too bad winning here doesn’t get you a trophy.

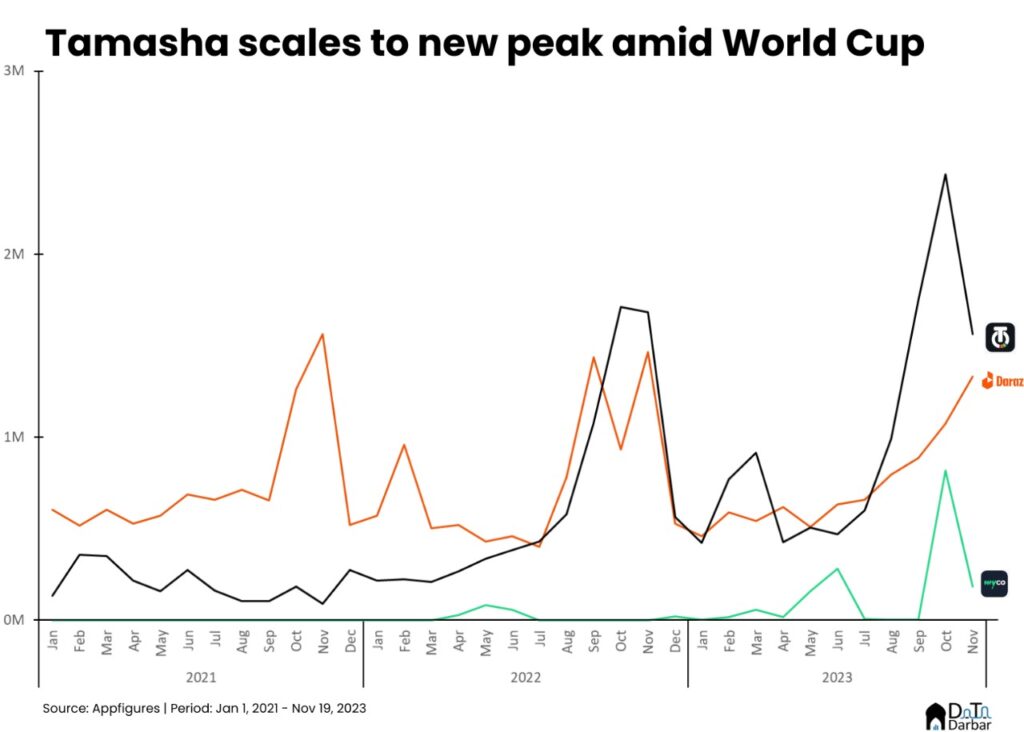

It was the opposite for Pakistan, with streaming apps doing well was probably the only consolation after a horrible campaign, both on and off the field. Jazz-owned Tamasha was unsurprisingly the leader with 3.8M installs during the World Cup. Daraz, which once again got the streaming rights, managed to get 2.3M downloads, though many would be because of the OND sales festival.

On the other hand, Tapmad failed to capitalize on the cricket craze. Despite being one of the oldest OTT platforms, it amassed only ~109K downloads during the World Cup. Meanwhile, the new(ish) kid on the block, myco, had a pretty good run and managed ~991K installs. Headquartered out of UAE but targeting Pakistanis, it’s a blockchain-based app that is testing the concept of “watch to earn”. Takes guts to still use those words.

World Cup’s magic effect on downloads

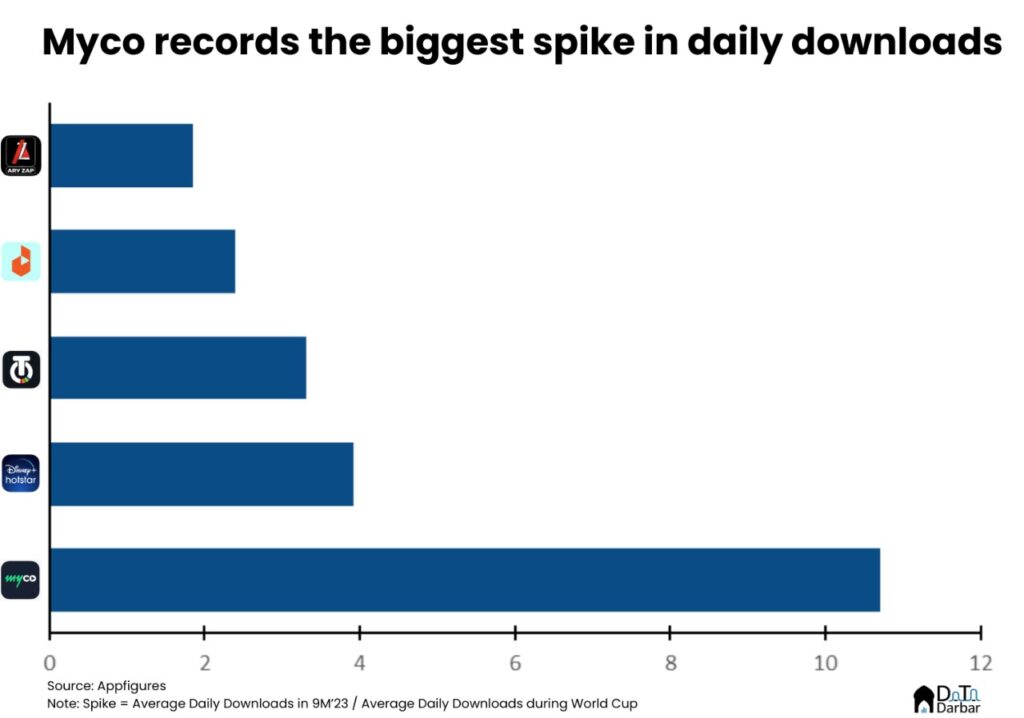

But we have only talked about downloads during WC’23 without context on whether the numbers are good, average or bad. So we decided to go all the way back to 2017 and looked at the daily downloads of the apps. As expected, the cricket craze in South Asia is pretty evident. For Disney+ Hotstar, the single biggest platform in our sample by far, the average installs per day spiked to 234K during the World Cup, from just ~60K in the first three quarters of the year. That’s an increase by a factor of 3.9!

Tamasha also witnessed a substantial jump from ~12.5K mean daily downloads in the first quarters to ~41.6K during the World Cup — translating into a spike factor of 3.3. It can now claim to be one of the biggest Pakistan-based apps with 14.5M monthly active users as of September end. That’s a 4.4x increase YoY. The reason? You guessed it, cricket.

As per Veon: “Tamasha served 14.4 million unique viewers during the 2023 Cricket Asia Cup games, the highest-ever audience figures on a digital video platform for a sporting event in Pakistan. In the nail-biting match between Pakistan and Sri Lanka, Tamasha served 4.8 million concurrent users demonstrating its leading technology and platform architecture. Tamasha ranked as the number one downloaded app on both the Apple App Store and Google Play during the Asia Cup.” Even its Bangladeshi platform, Toffee, reached a MAU of 12.1M.

But the biggest increase of 10.7x(!) was recorded by myco, as average installs per day surged to ~10.8K, albeit from a low base of just ~1K. Daraz too recorded a 2.4x growth, though we can’t say if it was the cricket effect or the November sales.

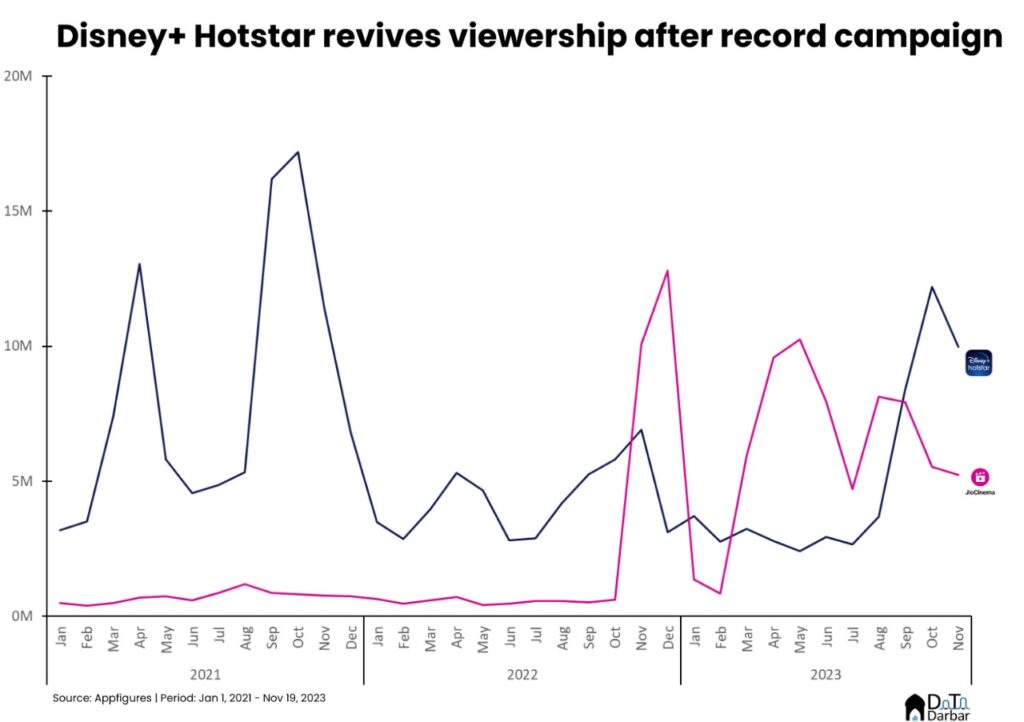

After getting crushed by the Ambani-owned Jio Cinema during the IPL, Disney+Hotstar finally played catch up by bagging exclusive rights to digital streaming of the World Cup. According to Apptopia, Disney+ Hotstar had 317M MAU during the 30 days ending with the World Cup final.

Beyond sports streaming

Though the impact of the ICC World Cup in boosting activity on streaming platforms is clear, there are differences in the extent of it. Where cricket is perhaps the only driver in Pakistan, India has a relatively more developed ecosystem. At least beyond multilateral tournaments. JioCinema [which is excluded from our sample due to World Cup streaming not being available on the app] saw the biggest (set of) peaks in downloads during FIFA 2022 and made its way into 15.3M devices between November 20th and December 18th. Similarly, the best period for Disney+ Hotstar came during September 2020 as Covid-19 marred the Indian Premier League. From the 19th to the 23rd, it saw more than 6M installs.

None of their biggest 10 days came during either the 2023 WC or the last two T20 editions. However, Pakistan was in a different league altogether where peaks almost neatly overlapped with major matches in multilateral tournaments. For example, Tamasha’s record daily downloads of ~112K came on the eve of the Pakistan vs India clash in the Asia Cup. Similarly, Tapmad also witnessed the highest installs of ~20K when the green shirts took on Sri Lanka in the final. The same theme plays across the top 10.

There can be many reasons for this, not the least that India has a far higher uptake of digital services. When Pakistani streaming platforms really came into the mainstream in 2021, they were already a few years ahead. Obviously, it helps that Hotstar and JioCinema are backed by two of the biggest business groups with unlimited spending power. Plus, they have access to vast local content through Bollywood and regional cinema.

We have neither. The country just doesn’t produce enough movies while TV series are still very much the stronghold of legacy channels that prefer to monetize via YouTube instead. Foreign content is obviously too expensive, made worse by the fact our currency depreciates every month. And Pakistani companies (including multinationals) don’t have the financial muscle to pull this off. Not yet at least.

Disclaimer:

- Yes, downloads are not active users but we are bound by data availability.

- While every app install is not for the World Cup, especially in Europe, Australia, and Africa. However, in South Asia, the cricket effect is unmistakable, even without citing any data point.

- Spike Factor = Average Daily Downloads in 9M’23 / Average Daily Downloads during World Cup