Brace yourselves Pakistanis, we are about to become a digital kingdom with sovereignty. After all, the incoming finance minister is someone who led the largest tech company with a banking license. Maybe this is what impressed the powers that be? But how digital is HBL? Last year, we did a deep dive on this, and with 2023 numbers out, it’s time for an update.

Once again, let’s get a few disclaimers out of the way. The state of financial reporting concerning digital scale is subpar where banks generally don’t share much. Therefore, we are bound by the available data. As things currently stand, almost all available information is on payments and virtually none on credit or investments. Hence, that’d be our focus. Secondly, for analyst notes, we use the open source intelligence framework, where possible, to avoid companies backtracking their statements.

Thirdly, this isn’t supposed to be a thesis and is, at best, an incomplete attempt at mapping the growth in digital channels. Finally, even though both ATM and real-time online branches technically come under e-banking, we exclude them. Instead, our focus is on the remaining channels: e-commerce, point of sale, mobile, and Internet banking. There are some other proxies for digital that we track. So let’s get into it.

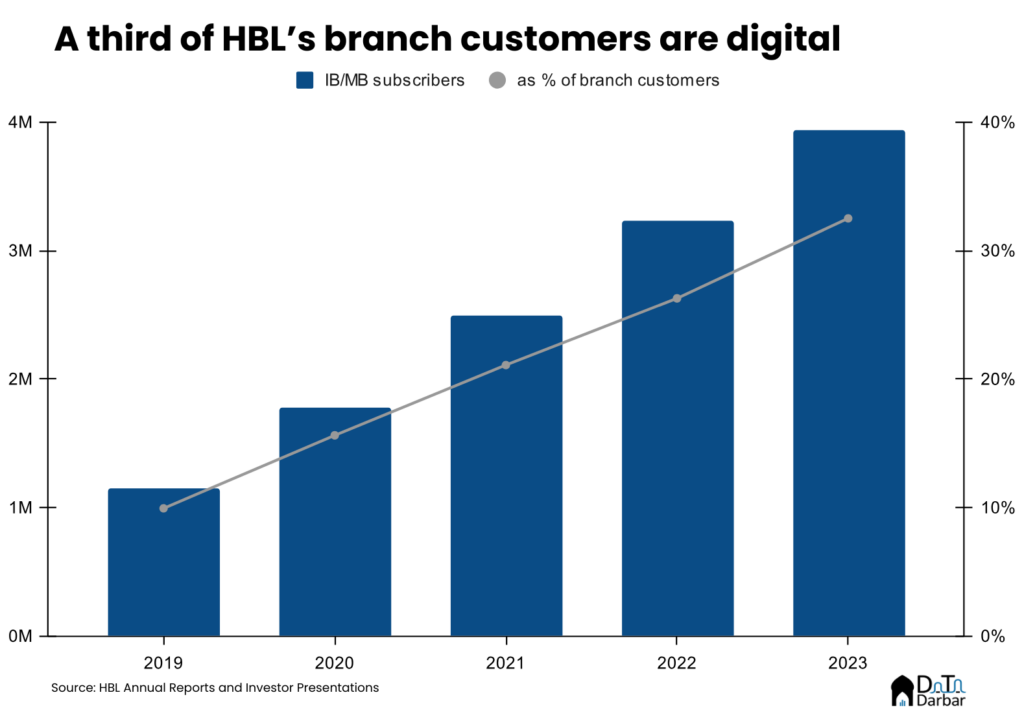

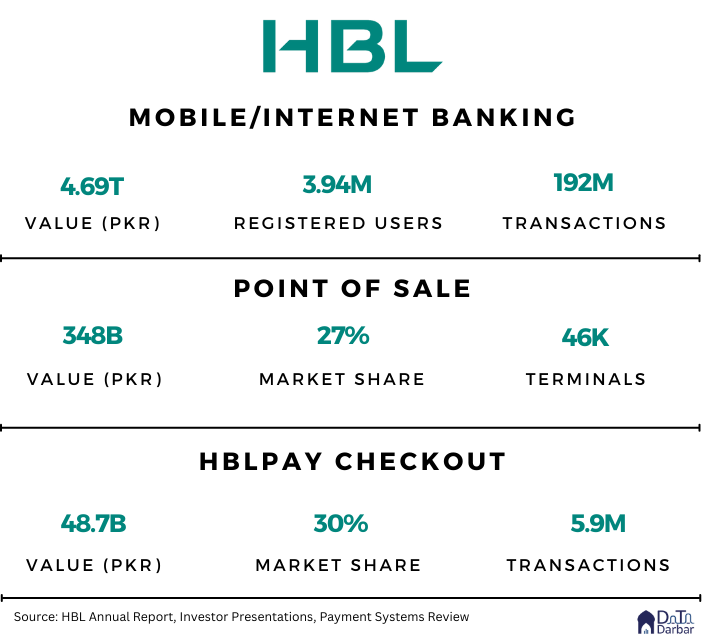

For starters, HBL’s total mobile and internet banking subscribers rose by 701K, or 21.7%, to 3.9M in 2023. In absolute terms, this is the highest industry-wide but only represents 10.6% of the bank’s customer base of 37M. However, that includes 9.1M registered people from Konnect, 4.4M through microfinance operations, and 11.4M from G2P social security disbursements like the Benazir Income Support Programme. Against branch customers of 12.1M, almost a third are now registered on HBL’s IB/MB channels. The mobile app alone accounts for 3.4M, of which 2.6M are monthly active1.

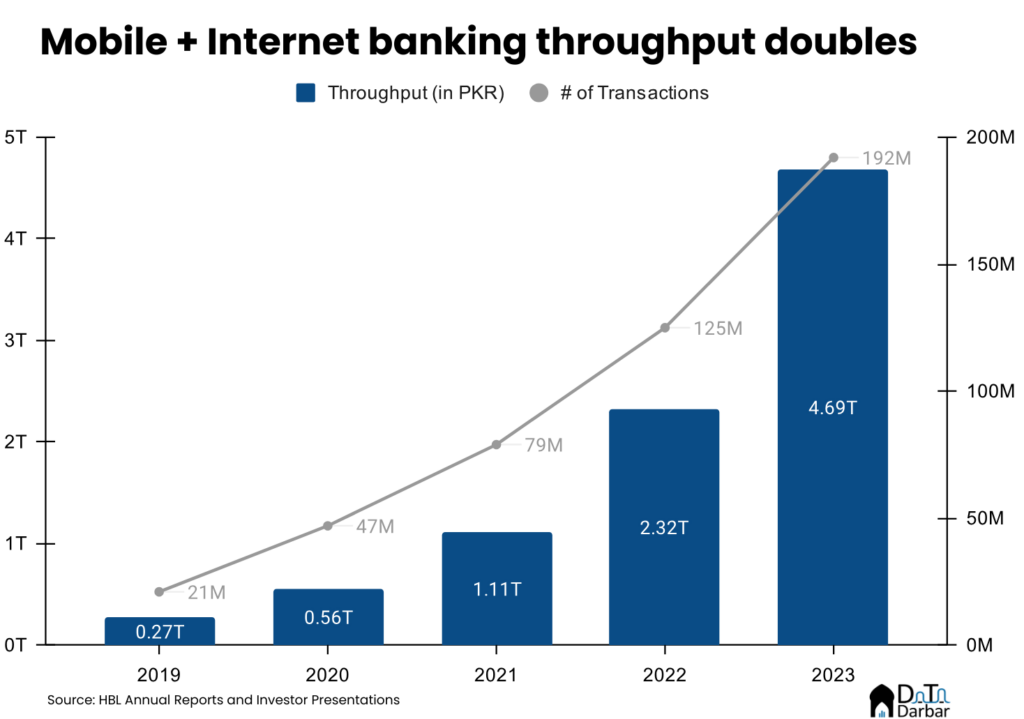

Transaction growth remains strong

On the transactions side, MB/IB throughput surged 101.7% to PKR 4.69T in 2023 while the volume jumped 54.6% to 192M. Consequently, the average ticket size further improved to PKR 24,411, from PKR 18,592 the year before, though it’s still less than half compared to the industry average of PKR 50,115 in 9M’23. That’s not necessarily a bad thing and possibly means that HBL’s customers are more likely to make smaller digital transactions. Do keep in mind that ideally these two channels shouldn’t be clubbed in the first place.

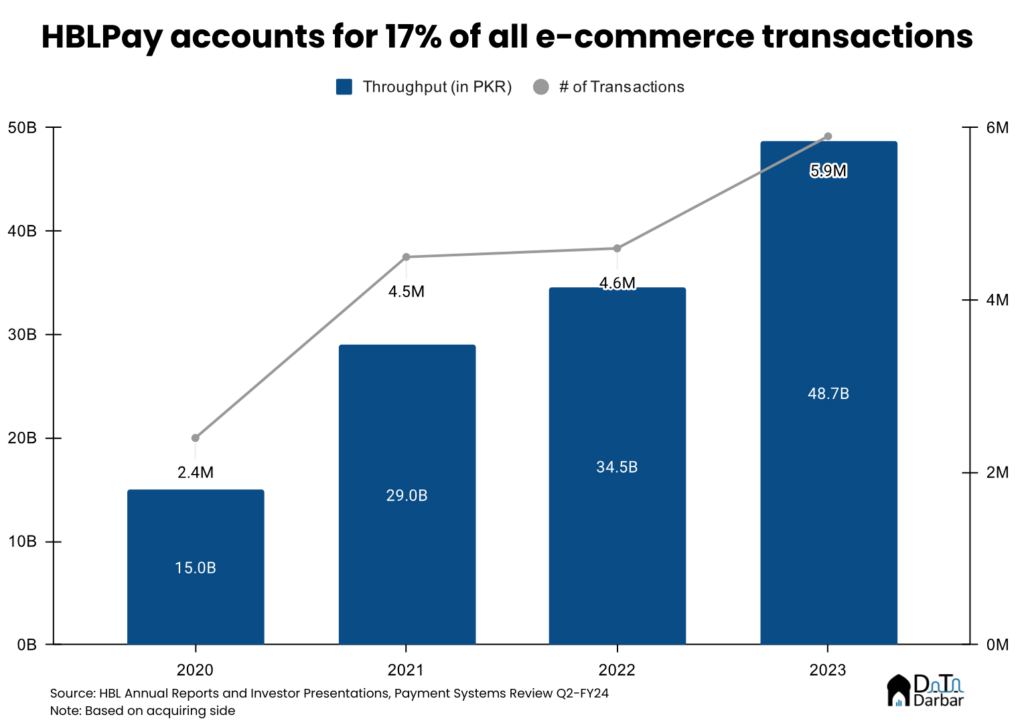

Meanwhile, the bank maintained its leadership in point-of-sale acquiring with a throughput of PKR 348B in 2023, up 31.8%. While the full-year data is not yet out, HBL has just under a third of the market share and accounts for 46,000 terminals — again the highest in the industry. Similarly, HBLPay Checkout, the e-commerce gateway, saw its value and volume increase by 41.2% and 28.3% to PKR 48.7B and 5.9M transactions, respectively.

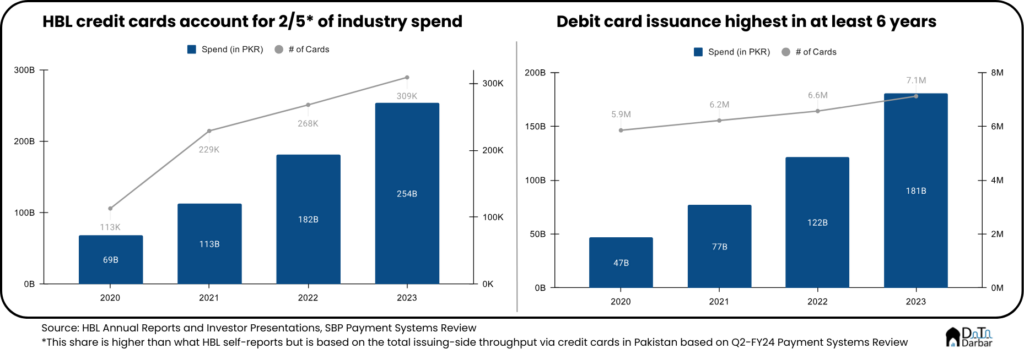

As usual, HBL’s issuing business had a good year with overall card spend rising by 27.2%, or PKR 93B, to close 2023 at PKR 435B. Of this, PKR 254B came from the credit side after registering a growth of 39.6% while debit was up 48.4% to PKR 181B. In comparison, issuance looked a lot tamer with 553K new debit and 41K credit cards on a net basis, translating into YoY increases of 8.4% and 15.3%, respectively. Unfortunately, the bank didn’t share the mix between e-commerce and point of sale.

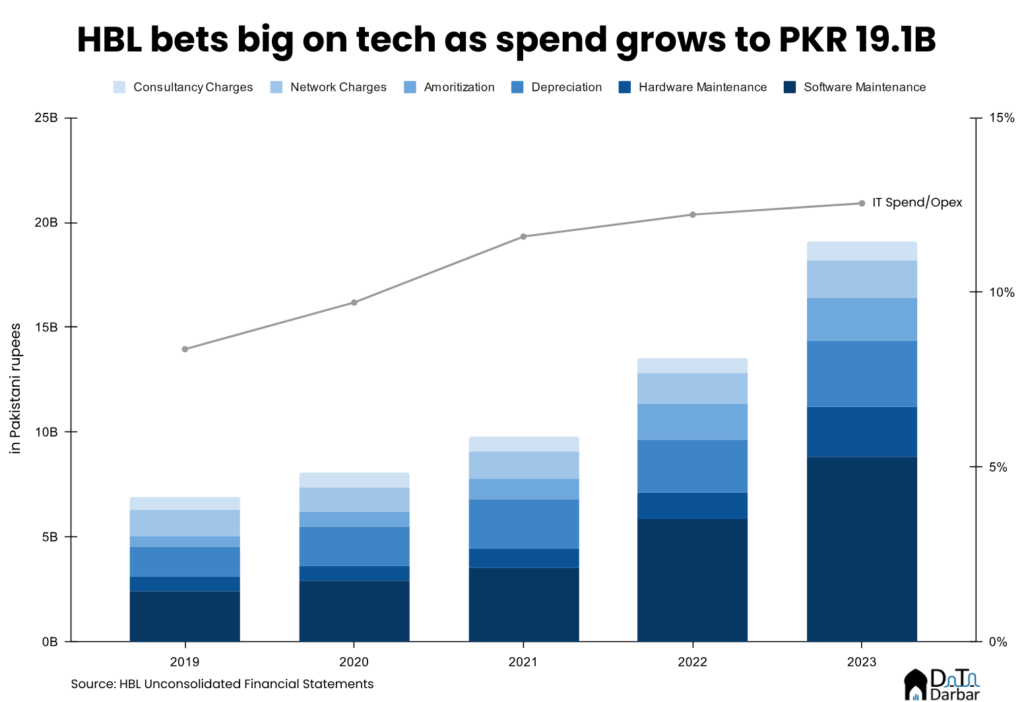

IT Spending Spree

We have also been tracking the IT spending spree of HBL where it accounts for over one-fifth of the total banking expenditure on technology. In 2023, it spent PKR 19.1B on information technology, up from PKR 10.5B the previous year, making up 22.7% of the industry2 total. For context, the second biggest spender — NBP — stood at PKR 7.3B even if their operations tell a completely different story. Almost 45% of the expenses went towards software maintenance, on par with the industry average.

Ideally, we should have done a peer analysis but unfortunately, there’s not enough available information yet. Despite growing digitization, Pakistani banks remain reluctant to make material disclosures and the regulator is not interested in changing the status quo either. Last year, we even created a template that the industry could follow but it clearly had no takers, other than probably Meezan. This lack of transparency and standardization has serious consequences, including on the shareholder value.

1 Ironically, HBL uses login in the past 90 days, instead of 30, as the criteria for monthly active users.

2 Based on 20 banks in our sample.

HBL dont tell about their customer services where they need to work alot. They dont answer on helpline dor 30 minutes, staff don’t cooperate.