Over the past few weeks, banking stocks have been under pressure in the wake of Sillicon Valley Bank’s debacle. Ever since that episode, probably more commentary has been written on it than the deposits held. Some, especially those on the more decentralized fringes, are as usual blaming the Fed for its monetary policy stance. Others raised question marks about a financial institution’s own risk management for it monumentally mismanaged the duration.

But amid this polarizing debate, we had a consensus on one thing: banking is not the same. Digital channels have pretty much replaced branches as the primary mode of service delivery. While that has exponentially improved customer experience, the speed has added another dimension to how we think about contagion risk.

Through digital channels, customers can withdraw funds in seconds, thus unimaginably intensifying the risk and speed of a bank run. Only further amplified by the doomsday tweets spreading further panic. That essentially means the traditional metrics to assess banks’ performance are just not enough and we need to analyze a lot more variables.

Yet, if you happen to go over the annual reports published by Pakistani banks this month, it’d feel like nothing has changed in the past couple of decades. They are still reporting the same old metrics, like the deposit base or profit after tax, to brag about their performance. Not that those indicators are any less irrelevant, just that they are no longer enough to give a complete picture.

Imagine two banks with the same levels of deposits, say one trillion rupees each. However, one of them has attracted these funds by opening a branch across the country and hiring 5,000 people while the other did the same by developing a sleek app managed by a 50-member team. As an investor, or even user, what’d be your pick?

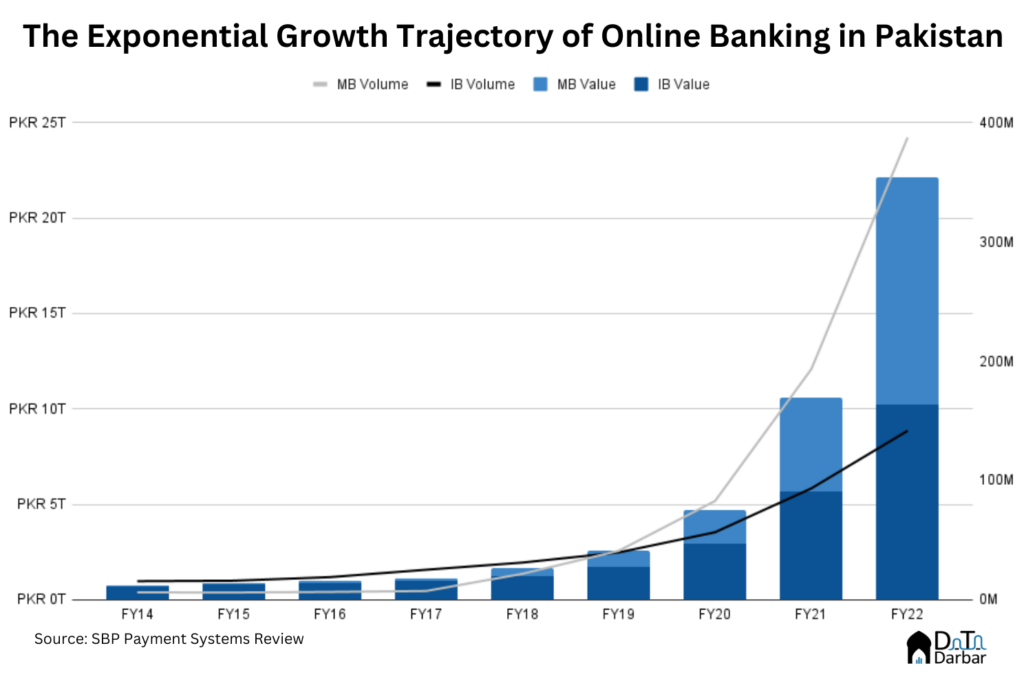

The growth and scale of digital payments in Pakistan

Over the last, Pakistan has seen an incredible uptake in digital retail payments: value of internet and mobile banking has surged from PKR 675.6B and PKR 67.4B in FY14 to reach PKR 10.25T and PKR 11.85T by FY22, respectively. Or compound annual growth rates of 35.3% and 74.8% and 77.6%. While you could attribute some of it to a low base initially, that’s no longer the case.

In fact, the volume of mobile and internet banking combined now exceeds paper-based transactions through banking channels. Based on this trajectory, they will even surpass ATM numbers in a few quarters — effectively making digital the biggest channel in the country.

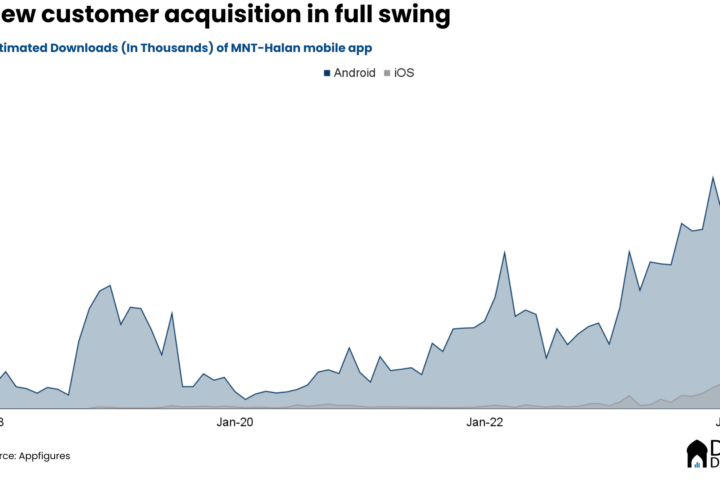

Now the issue is that Pakistani banks, by and large, don’t report those digital metrics. Or at least in much detail. Despite it being the fastest growing channel. This makes it pretty difficult to gauge a financial institution’s performance.

The reporting of digital metrics by Pakistani banks

Relatively speaking, HBL has by far been the best in reporting relevant numbers related to its digital operations. It comes with being a tech company with a banking license, I guess? The bank gives a sneak peek into the headline figures such as throughput by channel i.e. mobile and internet, point of sale, and so on. It also gives out monthly active users of their platforms as well as the overall spend by cards during 2022.

Read our deep dive on HBL’s digital operations here.

Meezan also does fairly well on this front and reports numbers related to card spend, POS and e-commerce transactions, plus the channel-wise digital vs over the counter mix among other things. This was a huge improvement from 2021 reporting quality where scant details were made available. That’s probably a function of scale, as the bank is now arguably the biggest digital player.

The list ends here. Of the 20+ banks with consumer footprint and digital products in Pakistan, only two have what we can call decent reporting. Even that is satisfactory, not exactly good or complete. That’s because they club numbers from different channels together, such as POS and e-commerce, and mobile and internet banking.

However, it’s unfair to complain about them when others are doing much worse. For example, Alfalah has more fluff than substance, bragging about meaningless stuff like being the “Pakistan’s first e-commerce buy-now-pay-later (BNPL) marketplace within a banking app”. But doesn’t bother to mention the transaction value or volume via internet or mobile banking.

UBL does worse, revealing little valuable information about its scale. Except for a cursory mention in text on total digital transaction value and one slide with four charts in its corporate briefing presentation. All while it boasts about being the best digital bank based on some award.

These are the top four banks in terms of digital readiness, according to our 2021 index. So imagine the state of reporting quality at other institutions. Take JS, which amped up its marketing spending by 206.6% to PKR 1.16B primarily to push its app, and yet provides few quality digital metrics on the progress.

Let’s not even waste our time on the likes of Bank Al Habib and MCB, which are competing with National Bank of Pakistan probably to see who does worse. Obviously financial reporting on digital metrics is a function of their online scale and experience, something these banks lag behind on.

Even when banks provide certain digital metrics, there is absolutely no standardization. One institution could provide mobile and internet together while another would club POS and QR. There’s also little context as to how they are defining or measuring those indicators. For example, if a bank reports IB throughput of PKR 100B, is it the amount sent or received? So if someone is bothering to aggregate channel-wise numbers from countless annual reports, the exercise is sort of futile.

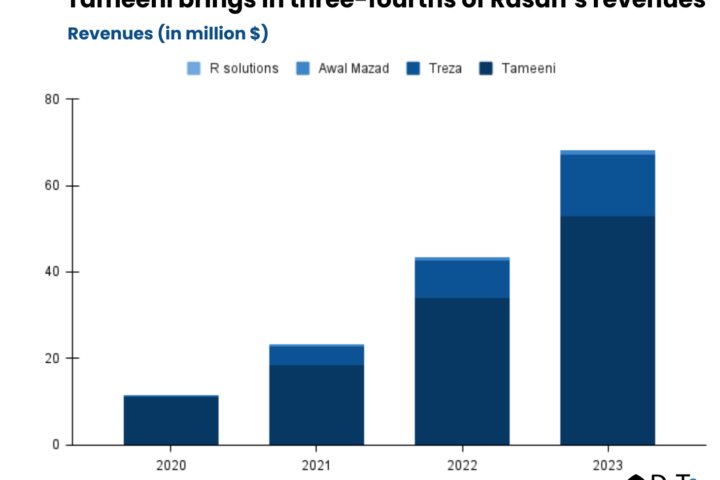

These are not just vanity indicators but key determinants of growth and shareholder value. For quite a few years now, Pakistani banks on average have been trading below price-to-book ratios of under one. And there are literally just two plays — digital and Islamic — to overcome that and attract investor interest. How do you do that? By telling a story, not with meaningless awards but numbers.

Maybe you’d forgive banks for not reporting indicators on digital operations. After all, they are used to doing the bare minimum and seem more than happy with feeding off government securities. But that’s why we have a regulator, right?

Less policy regimes, more data

Over the past few years, the State Bank of Pakistan has taken a series of measures to push for digitization. We have seen three regulatory frameworks for fintechs and countless circulars, opening doors for new players. But there is still data available on what all they — or the traditional financial institutions — have managed.

I mean the PSO/PSP rules came in 2014 and to this day, the SBP doesn’t publish their channel-wise throughput. Even for 1LINK and NIFT. Similarly, there doesn’t seem to be any standard format for banks to follow in disclosing their specific digital-related metrics. Given that SBP data is ~6 months old, how will anyone measure the industry — and an individual bank’s — progress? Maybe we just have to rely on fluff statements from their senior leaders and those awards? In that case, nothing is going to change no matter how many regulatory frameworks are introduced.

PS: Around mid last year, we took this responsibility and built a Digital Banking Readiness Index for 20 financial institutions. It essentially ranked each bank based on their digital scale — measured across three subindices: spending, reach and experience. The idea was to quantify how each player is doing and bring in some transparency in the industry. It was based on proxies (with reasonable explanatory power) so we went to the SBP for feedback to further improve the model.

We tried to nudge the regulator to share some data. If not that, at least require financial institutions to disclose a few metrics in their annual reports. More than eight months and countless follow ups later, no progress has been made on that front. But don’t worry, we’ll soon hear more empty talks about digitization and the umpteenth new licensing framework. Just not how the existing players have performed.

Thanks for sharing insights, I believe lot of credit goes to largest retail banks Easy Paisa and Jazz cash who are truly driving this change with their largest foot print of retail accord country they are adding close to 100b cash despite on monthly basis. Then HBL Konnect that my view more focus on disbursements of BISP but scale of pure consumer related transactions are on lower side as compare to Ep and JC.

Great post! It’s interesting to see how digital channels have changed the banking industry and added new dimensions to risk management. Do you think traditional banking metrics will need to be reevaluated to account for these changes?